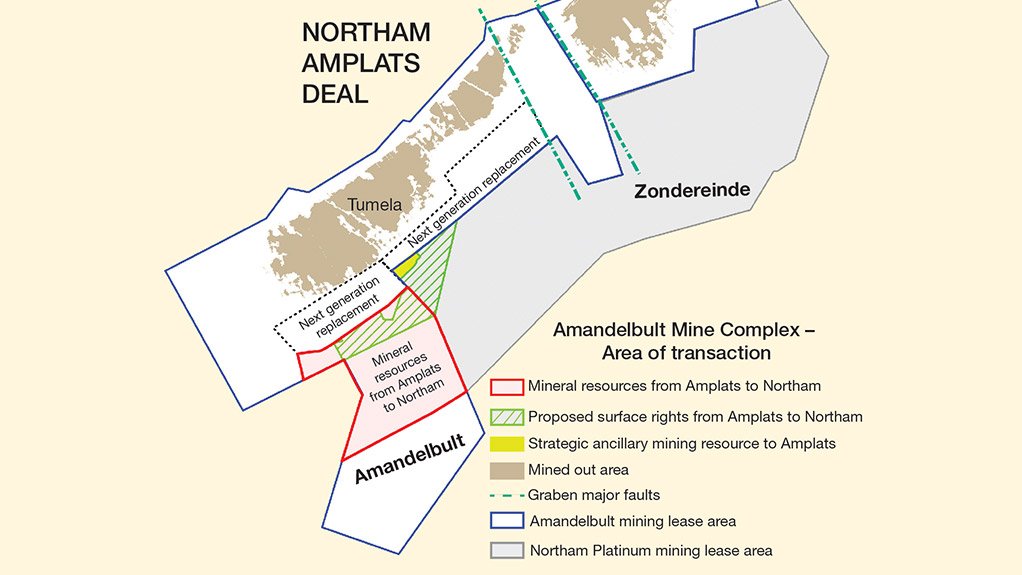

JOHANNESBURG (miningweekly.com) – A three-part transaction was announced on Tuesday when Northam Platinum and Anglo American Platinum (Amplats) each outlined a mix and match deal that involves R1-billion in cash for a large platinum mining resource area on the western limb of the Bushveld Complex, the exchange of surface rights above part of the area and the swopping of a small resource described as "strategic".

Northam is the payer of the R1-billion to Amplats for a large adjoining resource in the Amandelbult mining right area, which has the potential to extend the economic life of Northam’s Zondereinde mine to beyond 30 years.

Northam will also get a stretch of surface rights and Amplats the cash plus the small strategic ancillary mining resource that provides it with flexibility at the Amandelbult mine. (See attached map. Strategic ancillary mining resource shown in yellow.)

The deal, concluded with Amplats subsidiary Rustenburg Platinum Mines, gives Northam an area that mimics Zondereinde in character, with quick access from existing Zondereinde infrastructure at minimal capital cost.

Northam had no plans to mine the small strategic portion anyway as it does not fit Zondereinde’s favoured hydro-powered mining method.

Northam gets 16.7-million ounces of four-element platinum from both Merensky and upper group two (UG2) reefs, that extend down from 1 400 m below surface to 3.6 km below surface.

This means Northam will be able to continue to mine higher-grade Merensky ore for longer at relatively low incremental capital expenditure, which puts Zondereinde on a long-term footing similar to Northam’s far newer Booysendal operation on the eastern limb of the Bushveld Complex.

Northam CEO Paul Dunne describes the transaction as one that brings optionality to Zondereinde and Amplats CEO Chris Griffith says it allows his company to exit resources that fall outside of the company's life-of-mine plans, while at the same time providing greater flexibility at Amandelbult.

He adds that the R1-billion received for the resources will be used to reduce net debt still further and to strengthen the Amplats balance sheet.

The transaction is, however, still subject to the necessary consent being obtained from the Minister of Mineral Resources in terms of Section 102 of the Mineral and Petroleum Resources Development Act dealing with the renewal of rights.

Earlier this year, Dunne emphasised that the platinum mining industry is not mining at a rate anywhere near the forecast demand of nine-million ounces of platinum by 2025, the nominal global demand quantum based on a modest compound annual growth rate of only 1.5%.

South African platinum mines, which peaked at 5.5-million ounces of mined platinum in 2006, are expected to barely manage four-million ounces of primary supply this year, and fail to manage four-million ounces next year.

Price-dependent global platinum recycling is also in decline and all estimates of surface stocks are calculated to be insufficient to deliver what will be needed.

Analysis points to supply being nearly two-millions ounces short of the required nine-million ounces.

Dunne also made the point that chrome ore, a by-product of the UG2 reef, is becoming increasingly strategic for the Johannesburg Stock Exchange-listed company, which produced 45.1% more chrome in the 12 months to June 30 than the prior year and which expects to be producing at a rate of one-million tonnes of chrome ore a year as it doubles platinum production through a suite of four growth projects under way at a capital cost of R5.5-billion.

By far the biggest of these is the R4.2-billion, six-year, 240 000 oz/y Booysendal South project, which will reach steady state in 2022.

This project, already under way, is made up of two UG2 mining modules – accessed from a capital-lowering common central portal complex – and one small Merensky reef mining module, similar to the North mine.

At the company’s presentation of 15.7% higher production of 436 960 oz for the year to June 30 when operating profit declined to R383-million on a 6.3% margin, pictures of boxcut guniting and development of a pollution control dam were flashed on a large screen.

Work on an aerial conveyor system from a supplier in Austria will deliver ore from the central portal complex to a 250 000 t/m PGM concentrator plant and integrated chrome extraction plant 4 km away, which was acquired with the takeover of the Everest mine from Aquarius Platinum.

Dunne also flashed up details of the three other projects, which include the R300-million, two-year, 25 000 oz/y Booysendal Merensky Phase 1 project at the Booysendal North mine, on which R75-million has already been spent.

Infrastructure has already been established for initial mining to be accompanied by the development of the decline system so that additional mining sections can be established if needed and swing production can be provided.

The Booysendal UG2 North Deepening project, which involves the addition of two extra mining levels, is seen as a logical, capital-efficient extension of the original Booysendal footprint.

The conveyor-decline cluster for this R270-million, three-year, 30 000 oz/y project is already totally on reef and will thus offer an immediate payback element.

The fourth project is the R750-million Zondereinde smelter expansion project involving the construction of a 20 MW furnace and dryer. It follows on the extension of Northam's strategic partnership with platinum-refining company Heraeus, which has contributed the first €10-million of a total of €20-million in exchange for a renewal of the current refining arrangements and guarantees a supply of refined metal to the German company.

Northam’s mineral reserves have risen from 19.1-million ounces last year to 24.5-million ounces now, Creamer Media’s Mining Weekly Online can report.

Edited by: Creamer Media Reporter

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here