PERTH (miningweekly.com) – ASX-listed WPG Resources has exercised its option over the Challenger gold mine, in South Australia, announcing on Friday that it had entered into a joint venture (JV) agreement with underground mining contractor, the PYBAR Group.

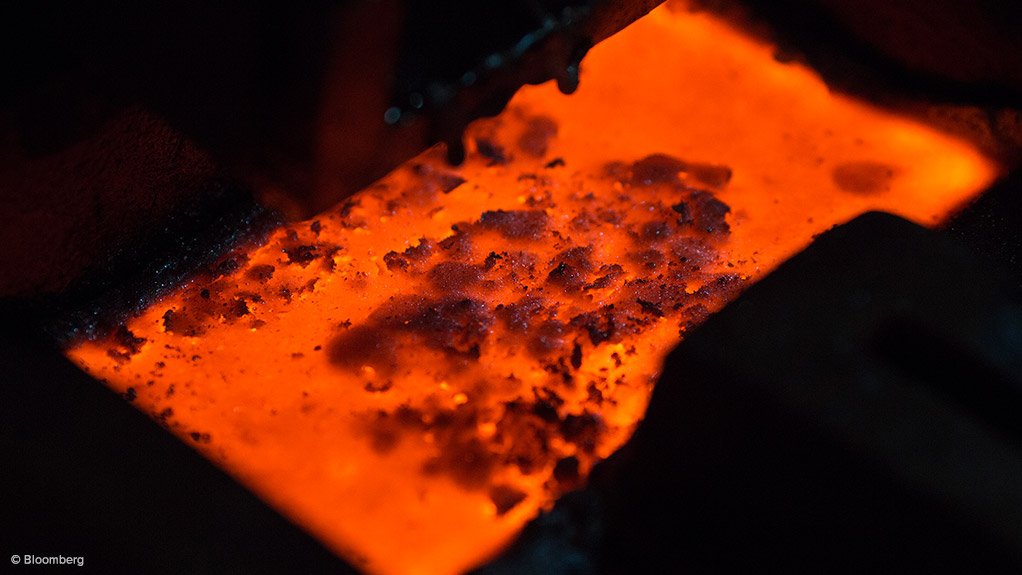

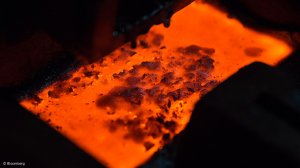

In October, WPG entered into an option agreement with gold miner Kingsgate Consolidated to acquire the Challenger mine for A$1-million, as well as a A$25/oz royalty on the Challenger south south west zone, which would take effect after the first 30 000 oz of production.

Following a six-week due diligence period, WPG and PYBAR subsidiary Diversified Minerals have now jointly exercised the option agreement, with the two companies entering into a 50:50 JV agreement.

Under the acquisition agreement, Kingsgate would continue to operate the Challenger mine until February 28, when the mine would be placed on care and maintenance, with no residual employee or contractor liabilities.

Kingsgate was hoping to produce between 20 000 oz and 25 000 oz of gold from Challenger between the end of the September quarter until the completion of commercial production.

The JV partners intended to reopen the Challenger mine after the development of a revised mining plan, based on the extraction of known resources. The focus would initially be on the Challenger West mineralised zone.

“The sale of Challenger signals the first strategic step towards securing a new future for the company,” Kingsgate CEO Greg Foulis said on Friday.

“We can now concentrate on pursuing new business and mine development opportunities to enhance our portfolio, including pushing ahead with our exciting development Nueva Esperanza, in Chile.”

Meanwhile, WPG on Friday announced that Diversified Minerals had agreed to subscribe for some 25.8-million fully paid shares in WPG, priced at 3.1c each, to raise A$800 000.

Shareholder approval for the placement was not required.

“We are delighted to be associated with an organisation of PYBAR’s calibre. We are really looking forward to bringing Challenger back into production and to benefiting from the potential synergies that are presented by the proximity of the Challenger mill and infrastructure to our 100%-owned Tarcoola gold project,” WPG executive chairperson Bob Duffin said.

Edited by: Chanel de Bruyn

Creamer Media Senior Deputy Editor Online

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here