State-owned electricity utility Eskom, alongside the South African government, has made significant progress in supporting battery energy storage systems (BESS), which is pivotal in ensuring energy security, load shifting and grid stabilisation at utility scale in South Africa, says independent power producer (IPP) ENGIE South Africa flexible generation senior business developer Shahil Juggernath.

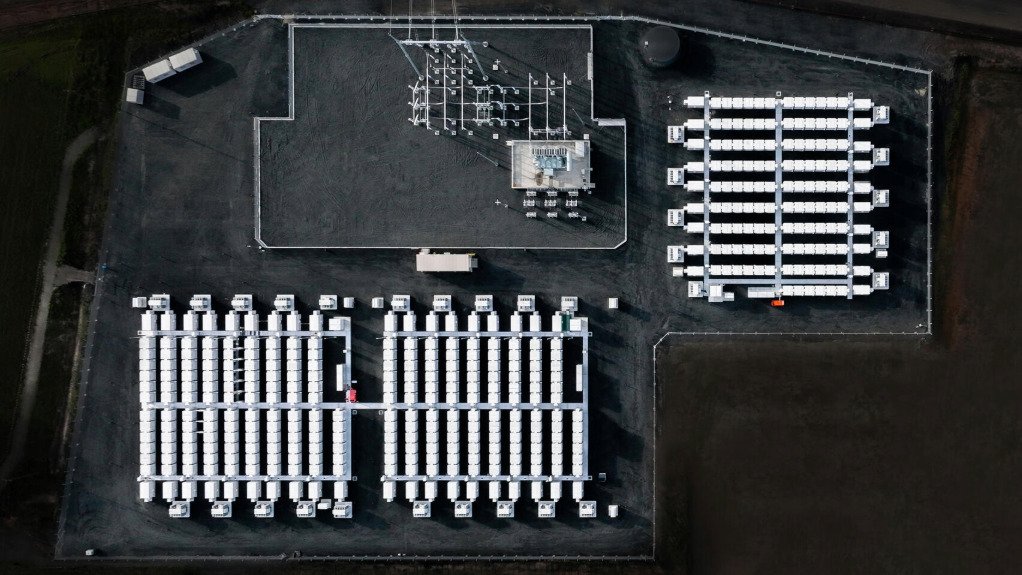

Eskom is a key early adopter, with over 300 MW planned for both phases of its BESS implementation project. These large-scale utility batteries will be installed at strategic points across the grid.

Eskom will also have access to around 2 GW of BESS, which will be installed through public procurement, allowing the utility to access and use the stored energy as needed.

This includes ENGIE’s Oya project, in the Komsberg Renewable Energy Development Zone, bordering the Western and Northern Cape provinces, which will result in the installation of 92 MW of battery storage as part of a hybrid renewable-energy solution, he explains.

Several private-developer initiatives have also reached financial close, with some already reaching commercial operation.

Eskom’s commitment to BESS through its engineering, procurement and construction schemes – alongside BESS that have been developed, built, owned and operated by IPPs and procured through the IPP Office – has accelerated BESS deployment in the country, says Juggernath.

The IPP Office was established by the Department of Mineral Resources and Energy, the National Treasury and financial institution Development Bank of Southern Africa in 2010 to deliver on the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) objectives.

“The rapid deployment of three bid rounds by the IPP Office, procuring about 6 976 MWh, has significantly accelerated the conversation around BESS in the country,” he says.

Government has also actively supported BESS development, with the Department of Forestry, Fisheries and the Environment introducing the Battery Exclusion Norm early this year to provide clear guidelines for the permitting of BESS sites to help streamline the process.

Additionally, the National Energy Regulator of South Africa has implemented an updated Battery Grid Code, further facilitating BESS integration.

Juggernath explains that the local regulatory framework, focusing on public procurement, provides significant incentives for local and international investors to rapidly deploy and expand BESS projects, consequently creating a favourable environment for accelerating the development of energy storage solutions.

Investment Opportunities

The liberalisation of the energy market has created new opportunities for private-sector investment, making BESS an attractive solution for companies to explore to help meet their energy needs.

“The process for developing, permitting, financing, constructing and ensuring grid code compliance for BESS projects is now clearer and more streamlined, encouraging further growth and investment in the sector.”

This progress has resulted in the rapid upskilling of the local workforce, brought tangible benefits to underserved communities and demonstrated the value of BESS within the national grid, adds Juggernath.

As a result, major companies and suppliers have recognised South Africa’s substantial BESS potential, driving competition, improving product quality and securing competitive prices.

International advisers and local lenders are also playing a leading role in financing BESS projects, offering innovative and cost-effective solutions, with Juggernath adding that “the local lending landscape is well advanced with BESS”.

Regulatory Improvements

The bid rounds launched by the IPP Office introduced an innovative approach to energy procurement, whereby connection points were limited to specific regions, ensuring energy was directed where Eskom needed it most.

“As with the success of the REIPPPP, this BESS procurement process has demonstrated how South Africa can lead in innovative energy procurement to meet national needs.”

However, while this approach benefited some private developers – particularly those already working on solar PV projects located near the connection points, as they could also permit these projects for BESS –those developers with further-flung projects faced tight deadlines to secure permits, Juggernath explains.

This has “energised the entire ecosystem” and set the stage for the future rollout of additional programmes, with certainty in procurement key to attracting investment, he says.

For BESS, a clear understanding of future demand is crucial for developers to build strong business cases, which can unlock greater cost savings and incentivise localisation efforts in the energy sector.

While acknowledging that delays and challenges in public procurement for BESS projects have occasionally impacted on timelines and investor confidence, Juggernath notes that this is to be expected in large-scale infrastructure projects.

He says streamlining the procurement process, such as introducing separate compensation models for ancillary services, would provide clearer business models and attract more investment.

Meanwhile, in addition to stabilising the grid as more renewable energy is introduced, BESS provides crucial ancillary services such as voltage support, frequency regulation and grid reserves.

A key challenge in the widespread adoption of BESS is the pricing structure for ancillary services, which are bundled into the overall costs of the public procurement rounds.

Juggernath suggests, therefore, that separately defining and compensating ancillary services would further incentivise market participants to offer greater reliability to the network.

Additionally, improved coordination among government, Eskom, private developers and financiers would ensure smoother project development and implementation.

“Overall, the foundation has been laid, and with continued incremental improvements to the procurement process, South Africa can strengthen investor confidence and ensure [that] BESS continues to play a key role in the country’s energy transition,” he concludes.

Edited by: Nadine James

Features Deputy Editor

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here