Trade, Industry and Competition Deputy Minister Fikile Majola has stressed the impact of the local steel industry and its importance to South Africa’s industrialisation, and the challenges that the sector is facing from local and global pressures, emphasising the need to build an “inclusive sector” that contributes to the economy.

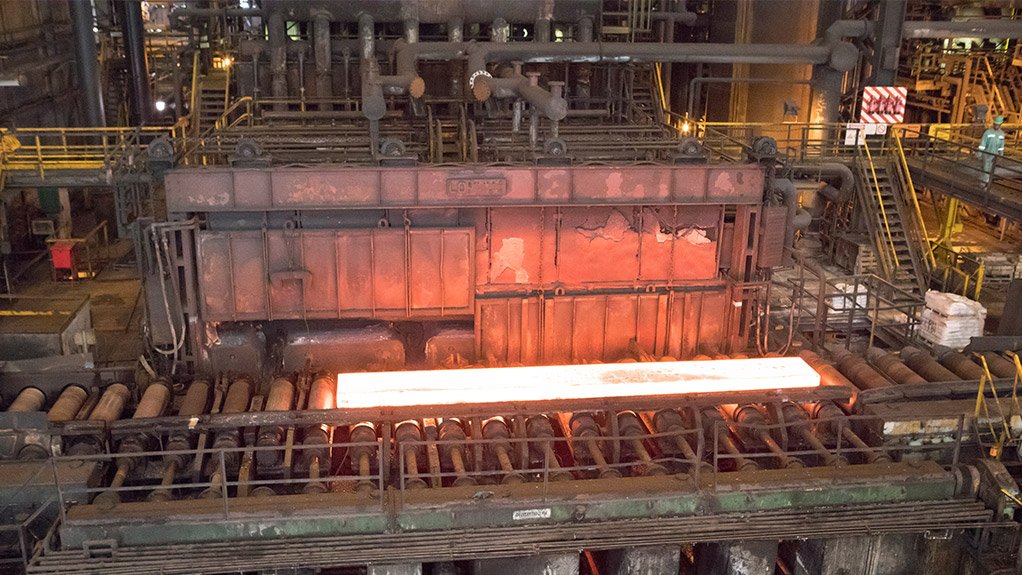

“Steel is one of the most important materials in the world. It is present in most aspects of the economy, from transportation and other infrastructure to more simple aspects like containers. Steel is used in the production of colossal structures, as well as small components for precision instruments,” he said in an address at the South African Iron and Steel Institute’s Southern African Steel Summit, held in Johannesburg on August 30.

“It is durable, adaptable and endlessly recyclable, making it the start of our journey toward reducing our carbon footprint.”

He pointed out that South Africa produced a number of valuable minerals used in the production of steel, as well as the steel, but noted the decline of the sector in recent years.

In 2010, South Africa accounted for 0.6% of global steel production, but this has since decreased to 0.2%.

Majola emphasised that the country’s steel value chain was vital to building a sustainable economy, with many sectors dependent on the steel industry.

“The value chain employs about 200 000 workers. Top steel-dependent industries such as mining, construction and automotive contribute about R600-billion to the country’s gross domestic product (GDP), about 15% of the total GDP, and employ about eight-million people,” he said.

Majola pointed out that the recently held Brazil, Russia, India, China and South Africa (Brics) Summit had presented opportunities for collaboration and sharing of knowledge to benefit the steel sectors in the member countries.

“The Infrastructure Working Group representing the Brics countries has committed to partner with the respective governments to create opportunities through various high-impact infrastructure projects.

“This partnership will focus on enhancing the connectivity among Brics countries, promoting the development of smart cities and providing financial support for the development of tangible and sustainable infrastructure projects,” he noted.

He said the Brics members had also resolved to convene a Sustainable Investment Development Symposium later this year. This will bring together Brics governments, investors and financiers to discuss ways to promote the use of environmentally and financially sustainable infrastructure delivery.

MASTER PLAN

Meanwhile, Majola said the development of the South African Steel and Metal Fabrication Master Plan was a testament to the importance of this industry to the economy.

“As government, we entered into a social compact with industry and labour to support long-term growth of the industry. The master plan has also been prepared to enhance the implementation of the reimagined industrial strategy and the Economic Reconstruction and Recovery Plan, both of which are primary movers for steel demand growth.”

He explained that government conceptualised the steel master plan as a turnaround plan aimed at improving the competitiveness of firms, addressing import levels and increasing exports, and positioning the industry to be resilient against global pressures.

“This is a social compact to stabilise and grow the steel and steel products industry to increase demand, reduce leakages owing to illicit trade and encourage localisation, increase and retain decent jobs, transform the industry and ensure the industry and workers are prepared for the Fourth Industrial Revolution and the green economy.”

He noted that the implementation of the master plan focused on a few priority areas.

These include demand-side and supply-side measures, exports, transformation, human resources development and skills development, as well as resource mobilisation.

“Since the master plan was adopted in 2021, 12 trade interventions have been implemented to support downstream industry competitiveness and growth. The price preference system was also extended for four years to ensure supply of scrap metal at competitive pricing to support value addition,” Majola said.

The Industrial Development Corporation of South Africa (IDC), through its own balance sheet and the Downstream Steel Competitiveness Fund, has directed funding to support projects in the value chain.

In 2022, investments worth R5.2-billion were facilitated by the IDC, and 2 230 jobs were supported across the value chain. To support greater export efforts, the IDC has also partnered with the Export Credit Insurance Corporation and has established an intra-Africa trade facility to cover both commercial and political risks.

He also pointed out that an Energy Resilience Fund was launched in July this year, with R1.15-billion in contributions from the IDC to support firms on the supply and demand side to mitigate against the energy challenges the country was experiencing.

The IDC also intends to reduce the impact by providing concessionary funding to energy services companies to enable them to supply financed energy solutions to small-, medium-sized and microenterprises across all sectors of the economy.

Majola further stressed that the carbon intensity of the local steel value chain must remain a focus for the industry.

He also discussed the impact that environmental initiatives such as the carbon tax can have on industries such as the local steel industry, and that the European Union (EU) plans to implement a carbon border adjustment mechanism (CBAM) from October this year.

The CBAM stands to negatively impact on South Africa’s manufacturing sector, particularly the steel and iron industries, as the EU will impose a tariff on imports from other countries equivalent to the carbon prices being paid by European companies.

This is a significant challenge for South Africa, with many industries still being reliant on carbon-intensive electricity to produce their goods.

“There’s about R10-billion of exports, based on 2022 data, at risk. This represents 2.3% of South Africa's exports to the EU. The risk exposure is amplified by the fact that the EU is a major export destination for South Africa's exports, which accounted for 21.8% of South Africa's total exports in 2022.

“The decarbonisation of the primary steel industry remains key as an input into greener production further down the value chain. End-user industries are showing growing interest in carbon-reduced products to decarbonise their own value chains and reduce market access risks.

“With the effective implementation of the social compact between government, business and labour, the domestic industry will bounce back and regain its position in the global arena.

“If we choose to pursue our own narrow interests at the expense of a shared agenda, we then run the risk of further de-industrialisation. I urge us all to rally behind this master plan as our chosen roadmap for steel industry value chain growth and development,” Majola said.

Edited by: Chanel de Bruyn

Creamer Media Senior Deputy Editor Online

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here