Financial services firm Standard Bank and China National Building Materials International (CNBM) have concluded a R600-million sustainable finance solution.

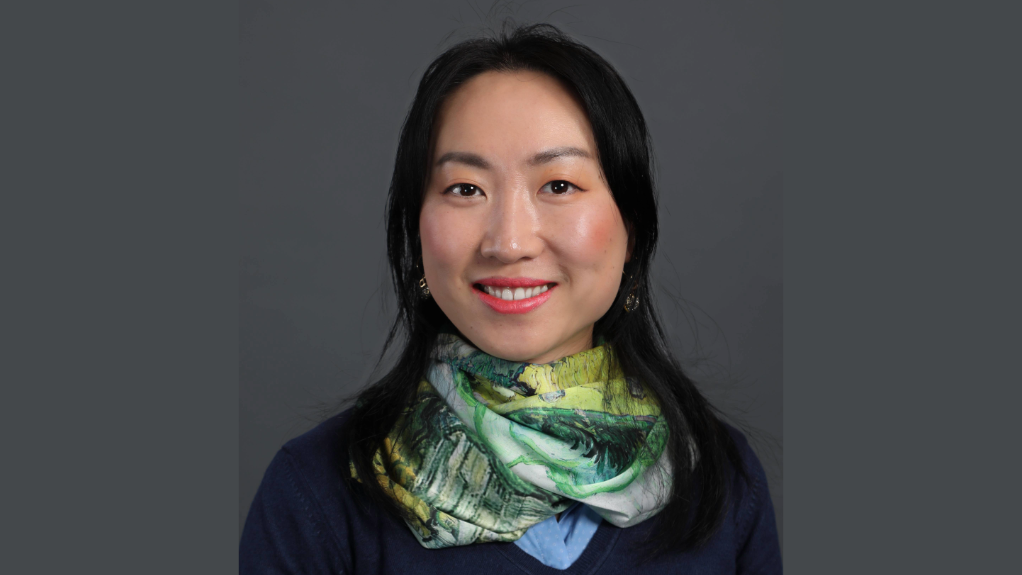

The strategic financial package, comprising a R500-million invoice financing facility and a R100-million working capital facility, is set to enable more South Africans to access affordable solar energy solutions, says Standard Bank China segment head for South Africa and core markets Lydia Zhang.

“The finance solution provided supports both positive environmental and social impact across the continent, including supporting the continent’s just energy transition (JET). With most of South Africa’s energy being generated from coal, providing accessible and affordable renewable-energy alternatives is a key pillar to enabling the country’s JET,” she adds.

The transaction marks Standard Bank’s first sustainable finance invoice financing facility with a client and requires CNBM to report yearly on key impact metrics, underscoring the project’s emphasis on sustainable outcomes. This collaboration also aligns with CNBM’s growth and sustainability objectives.

By facilitating the transition to renewable-energy sources, Standard Bank intends to reinforce its commitment to fostering a sustainable future.

Further, in terms of its climate policy (initially published in 2022), the bank has pledged to mobilise more than R250-billion in sustainable finance from 2022 to 2026, showcasing the transaction with CNBM as one of the examples of its commitment to fostering positive environmental and social impacts.

The customised solution caters to CNBM’s finance requirements, addressing multi-currency procurement needs while incorporating trade finance to optimise working capital cycles and embedding sustainability into the solution.

“This approach not only supports clients’ business growth needs but also integrates sustainability into the financial solution, underlining Standard Bank’s role in enabling high-quality solar and energy storage solutions vital for South Africa’s JET,” Zhang says.

She adds that, through such financial partnerships, the bank demonstrates its ability to assist clients across various sectors, offering tailor-made sustainable finance solutions that support their unique transition needs, thereby contributing significantly to the continent's sustainable development trajectory.

Edited by: Nadine James

Features Deputy Editor

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here