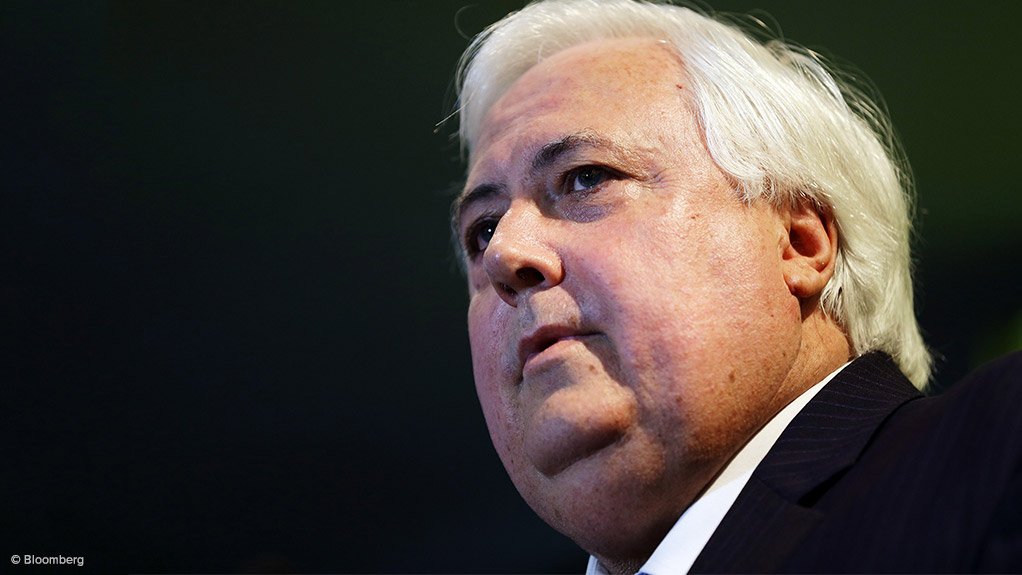

PERTH (miningweekly.com) – Mining personality Clive Palmer on Thursday said that embattled refinery Queensland Nickel was only experiencing a “small deficit” in cash flow, adding that the company was in fact in a strong cash position, with about A$1.95-billion of unencumbered net assets.

Palmer said in a statement that despite unencumbered assets of nearly A$2-billion, the company was denied a A$35-million overdraft by the four major Australian banks, as the financial institutions had chosen not to invest in the resources sector during the downturn in the commodity cycle.

As a result, Queensland Nickel had turned to the state government for assistance.

However, Palmer said that the company was not requesting taxpayer funds, but rather a guarantee from the Queensland government which would act as security for the A$35-million overdraft.

“In my assessment, this is a risk free proposition that would ensure the continued operation of the refinery. Queensland Nickel is not asking for money like the A$40-million a year the government pays to the foreign-owned Boyne smelters in Gladstone,” Palmer said.

“I have personally sourced meetings with Premier Annastacia Palaszczuk to help resolve this issue but she is continually not available or not interested. It’s disappointing that the Premier and Treasurer Curtis Pitt do not seem concerned about the people of North Queensland, they obviously lack leadership and compassion,” he added.

The Treasurer earlier this week said that the state government had not made any decision on whether to bail out Queensland Nickel.

Queensland Nickel is one of Australia's biggest nickel refineries with a capacity of 35 000 t/y, and is responsible for approximately 722 direct jobs and at least 1 500 indirect jobs.

Edited by: Mariaan Webb

Creamer Media Senior Deputy Editor Online

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here