The potential imposition of an Extended Producer Responsibility (EPR) tax by the Department of Environmental Affairs will have a negative impact on the packaging industry, which may result in the collapse of numerous packaging manufacturers in South Africa, says Packaging South Africa executive director Shabeer Jhetam.

EPR is an environmental policy approach implemented for producers. It requires all producers of goods to assume accountability for overseeing the life cycle of their products.

“It would increase the cost of consumer goods across the board. However, a generalised packaging tax based on the customs and excise act would be higher than the cost of an EPR model managed by the industry. Like the tyre and carrier bag levy, however, this EPR tax would impact on all consumers as well as industry,” explains Jhetam.

He adds that a tax collected by government will not be ring-fenced, therefore, there is no guarantee that the intended use of the levy, to stimulate the paper and packaging recycling economy and develop secondary economies, will be realised.

Further, he highlights that, should the tax be managed by government, industry may reduce efforts in the recovery of paper and packaging.

“Government would be legally responsible for fulfilling the producer’s responsibility of managing the EPR tax. This shift could result in a decrease in recycling rates and collectors losing their source of income, among others.”

Packaging South Africa states that there are measures in place to build on the successes of the existing voluntary systems already in place and mitigate the potential repeat of some of the challenges of the tyre and plastic bag levy models.

Through its EPR plan – which is an industry led-, industry-managed model that aims to grow recycling volumes – the industry intends to work closely and in collaboration with government to achieve common goals of socioeconomic transformation through inclusive growth. The aim is to establish a system of packaging waste management that will create the greatest environmental benefits with minimal economic cost and effort while ensuring enterprise development, job creation and transformation within the packaging sector.

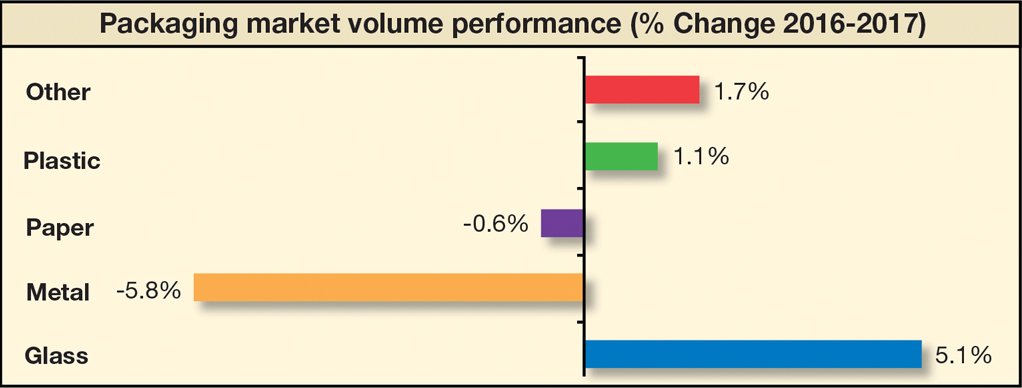

Meanwhile, the packaging industry – which comprises glass, metals, paper and plastics – projects sales growth for this year of a mere 1.2%. Jhetam notes that this is also as a result of the economic downturn as well as imports of cheaper packaging.

He adds that the consumers’ lower disposable income has resulted in the demand for packaging having plateaued.

The industry – which employs more than 100 000 people – is estimated to be worth R67.5-billion a year. However, Jhetam maintains that there is very little or no organic growth in the packaging industry, as volumes of packaging and paper placed in the market are declining or stagnant at best.

Jhetam notes that no packaging stream is currently doing well. Volume declines are also attributable to light-weighting of certain types of packaging – for example, metal beverage cans have been changed to aluminium, which is lighter than steel/tinplate.

Edited by: Zandile Mavuso

Creamer Media Senior Deputy Editor: Features

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here