JOHANNESBURG (miningweekly.com) – Platinum mining company Anglo American Platinum (Amplats) on Tuesday advised its shareholders to expect a sharp fall in earnings of between 45% and 67% for the six months to June 30.

The JSE-listed platinum major advised that headline earnings for the first half of the year are likely to decrease to between R550-million and R875-million, compared with last year’s restated R1.65-billion, and headline earnings a share to between 210c and 335c a share, compared with last year’s restated 629c a share.

The expected earnings decreases are primarily the result of attributable post-tax impairments totalling R2.2-billion, as well as strengthened local currency and a smelter problem, which lowered refined production.

The impairments impacting only basic earnings included R900-million on the sale of the company’s interest in Union mine and its shareholding in Masa Chrome, as well as equity interests in Bafokeng Rasimone Platinum Mine of R950-million and Bokoni Platinum Holdings of R45-million.

The impairments that impacted basic earnings as well as headline earnings include the writedown of a term loan to platinum company Atlatsa, operator of the Bokoni joint venture (JV), and a loan to the Bakgatla Ba-Kgafela community related to their interest in the Union mine.

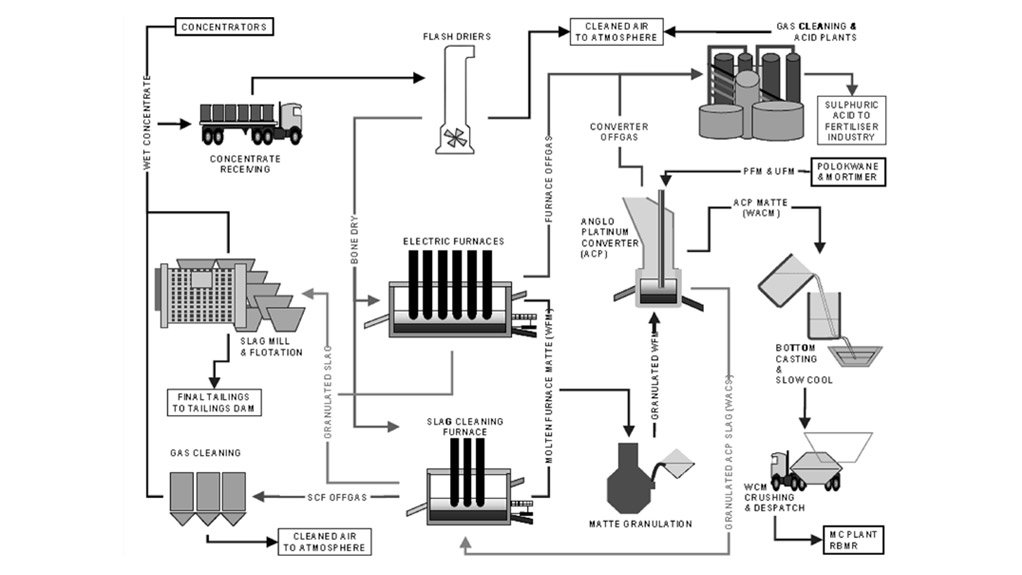

In addition, earnings were hit by a “significant” rand strengthening and lower sales volumes on impacted refined production, which fell as a result of last year’s Waterval furnace number 1 smelter run-out and Waterval furnace number 2's first-quarter rebuild.

Furthermore, on June 4 a high-pressure water leak at the Anglo Converter Plant (ACP) created a backlog of material, deferring 90 000 oz of refined production into the second half of this year.

The result of the planned rebuild of Waterval number 2 furnace and an ACP Phase A event impacted refined production for the period, lowering sales volumes, the company said in a release to Creamer Media’s Mining Weekly Online.

Amplats, headed by CEO Chris Griffith, said last month that results for the year were likely to even out in the second half owing to the build-up of work-in-progress material, which would result in more material being refined by year-end, given that both Waterval furnaces are back in steady state.

All platinum mining companies are currently battling the low platinum price, which at the time of going to press was $922/oz.

Mineral Resources Minister Mosebenzi Zwane on Friday received a presentation from the Platinum Leadership Forum, led by CEOs of platinum mining companies operating in South Africa, on the current plight of the platinum sector and the need for government collaboration.

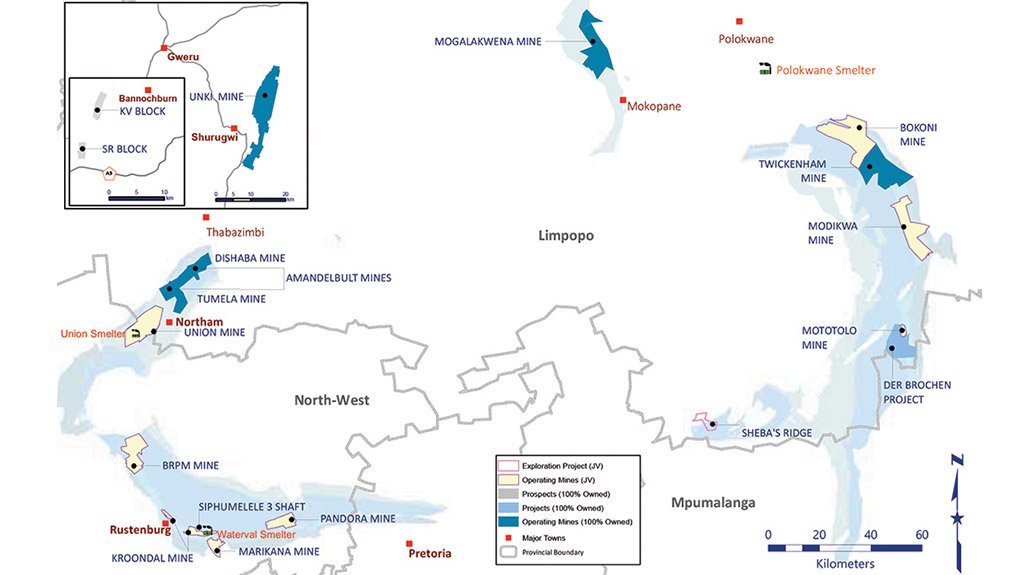

As can be seen on the accompanying map, Amplats, in addition to its six 100%-owned mines and three 100%-owned process plants, has half a dozen JV operations and virtually the same number of JV projects in South Africa's platinum-rich Bushveld Complex. Also attached is a diagram showing the ACP and its role along platinum's processing route.

Edited by: Creamer Media Reporter

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here