The electric steel producers of South Africa are calling on government to keep the export tax on scrap steel in place as it helps ensure the viability of greener domestic steel production by enabling sufficient scrap availability.

Owing to an oversupply of steel in the global and local market, the South African government currently faces, what the group describes as, “a critical decision to either safeguard the future of the entire steel industry or prop up [multinational steel manufacturer] ArcelorMittal’s outdated and heavily polluting operations”.

South Africa’s electric steel producers comprise manufacturers such as SCAW Metals, Cape Gate, Veer Steel Mills, Unica Iron and Steel, Force Steel and Coega Steel.

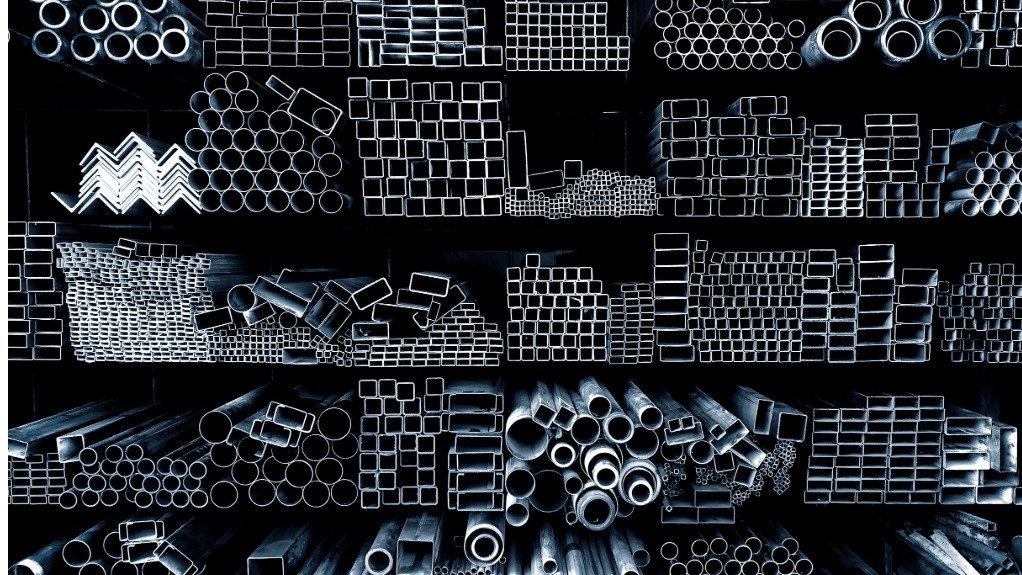

The group rely on scrap ferrous steel as a critical raw material to produce long products, including steel bars and wire rods, which are used for construction and mining applications.

ArcelorMittal South Africa (AMSA), which still produces steel from iron-ore in a “heavily polluting process,” is pushing for government to remove the scrap metal export tax – a move that would cripple smaller, greener steel producers that collectively make up 75% of South Africa’s long steel production capacity.

“Removing the export tax would threaten the survival of many local steel mills, lead to thousands of job losses and undermine the government’s stated commitment to industrial diversification and sustainability,” the group notes.

Further, scrapping the export tax would also “fly in the face” of urgent calls to recycle and decarbonise by moving away from iron-ore-based steel production.

To support this objective, many countries have legislated measures to protect and retain their scrap metal for beneficiation into cleaner, greener steel products.

“Together, our newer and more environment-friendly steel manufacturing processes, support well over 5 000 jobs, and are better suited to access international markets, which place ever-increasing stringent standards on the origin of steel imports,” the group stresses.

Affordable scrap is made possible by the tax instituted on scrap metal destined for export, which, in turn, encourages local use.

The tax allows local steel firms to access scrap to create finished products, in line with government policies designed to enhance local industrialisation and beneficiation.

The group avers that manufacturing within South Africa makes “far more economic sense” than allowing foreign companies and countries to benefit from using locally-produced scrap steel to support their industries.

The group also notes that AMSA already benefits from government protection in the flat steel sector, where “despite the fact that it has a virtual monopoly in local flat steel production”, government tariffs protect the company from lower-priced flat steel imports.

Further, the group stresses that AMSA’s “poor financial performance” is independent of the scrap export tax.

While the group agrees that lowering electricity and transport costs is vital, as requested by AMSA, it adds that prioritising AMSA at the expense of greener producers would only serve to hurt the broader economy and likely lead to the closure of the firms involved in more environment-friendly steel production.

The group calls on government to be more even-handed in addressing the oversupply of local steel, rather than favouring AMSA.

“It is time for the government to craft a balanced, forward-looking steel strategy that protects all players in the sector, ensuring a competitive, greener steel industry that aligns with global trends.

“South Africa cannot afford to favour a single company at the cost of thousands of jobs, industrial sustainability, and a vibrant, competitive market.”

The group concludes that it looks forward to engaging with the government to ensure that decisions are taken in the best interest of the entire steel industry and the country.

Edited by: Nadine James

Features Deputy Editor

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here