TORONTO (miningweekly.com) – Privately held research and development company Grafoid Inc has signed a memorandum of understanding (MoU) with China’s largest exporter and producer of tungsten, Xiamen Tungsten.

The agreement was hailed by Grafoid chairperson Jeffrey York as a turning point in Grafoid’s global technology enterprise platform expansion.

Under the terms of the MoU, Xiamen would buy a 20% equity position in Grafoid through acquiring common shares, including about seven-million shares currently held by Grafoid’s affiliate Focus Graphite.

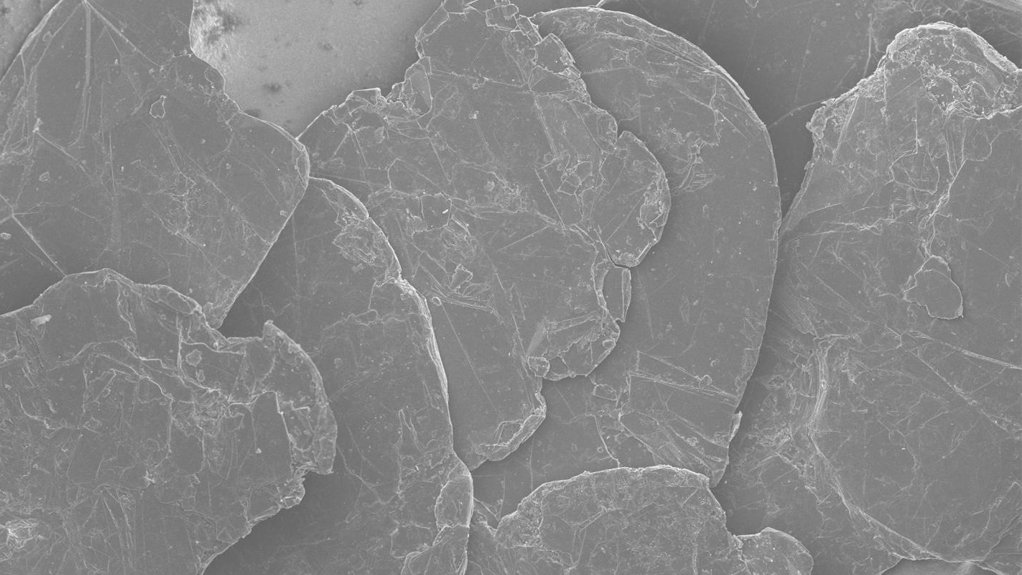

Grafoid and Xiamen had also proposed to form a joint venture (JV) in China under which they would produce Grafoid’s suite of technologies, including its Mesograph- and Amphioxide-based products, and the parties had also agreed to jointly develop graphene applications for the Chinese market.

Grafoid advised that the funding method was to be determined through negotiations for both the JV and application development components of the MoU, which could see applications spun out as JVs and eventual initial public offerings.

Investment details of the multimillion-dollar agreement were to be determined by a due diligence process scheduled to be concluded by May 22.

“This agreement represents our long-held corporate vision of developing a global platform of critical materials for the green economy including next generation energy applications, graphene coatings and polymers,” Grafoid CEO Gary Economo stated in a press release on Wednesday.

CHINESE PORTAL

Grafoid's announcement resulted in a 43% rise in Focus Graphite’s TSX-V-listed stock to C$0.20 apiece on Wednesday.

Focus, which is developing the Lac Knife graphite project, in Quebec, had signed two definitive ten-year offtake agreements with Grafoid in September last year, under which Grafoid had committed to take up to 1 000 t/y of high-purity (98.3% total carbon) large flake (+80 mesh) graphite concentrate from Lac Knife, as well as up to 25 000 t/y of 97.8% total carbon graphite concentrate containing all flake sizes.

Economo, who was also CEO and director of Focus, advised in a separate statement that the proceeds from the pending sale of Grafoid shares held by Focus would be applied to the company's continuing efforts to bring the Lac Knife project into production.

The company would specifically use the cash injection to advance the detailed engineering process at Lac Knife, as well as finalise the environmental permitting process, which would enable the company to move to the project financing phase.

“When finalised, it will provide additional funding to allow us to advance our overall mine and transformation plant financing, and potentially open the China market to Focus Graphite for additional offtake partners and the sale of value-added graphite products,” he said, underlining that the MoU provided Focus with a portal in China for the future sale of value-added graphite products through its strategic partnership with Xiamen.

Edited by: Chanel de Bruyn

Creamer Media Senior Deputy Editor Online

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here