VANCOUVER (miningweekly.com) – The dismantling of former precious metals producer Primero Mining is nearly complete with the company announcing on Friday that Mexico-focused miner First Majestic Silver will buy the distressed company for $320-million.

Under terms of an arrangement agreement between the two companies, all of Primero’s issued and outstanding common shares will be exchanged for First Majestic common shares at a ratio of 0.03325 of a First Majestic common share for each Primero common share.

The exchange ratio implies payment of C$0.30 per Primero common share, based on the 20-day volume weighted average price of the First Majestic common shares on the TSX on Wednesday, representing a 200% premium to the weighted average price of Primero common shares on the TSX over the same period.

The deal saw Primero’s TSX-listed equity more than doubling on Friday morning to a high of C$0.28 apiece – a slight reprieve from the stock’s dismal fall from grace over the past 12 months and a far cry from the 12-month high of C$1.21 a share. The stock soared as high as C$8.55 apiece on June 1, 2014.

The cash and scrip deal also contemplates First Majestic settling all amounts owing under Primero's existing revolving credit facility, which stood at $77-million at the end of September, net of Primero cash on hand and the expected repayment of Primero's $75-million of outstanding convertible debentures and various transaction expenses.

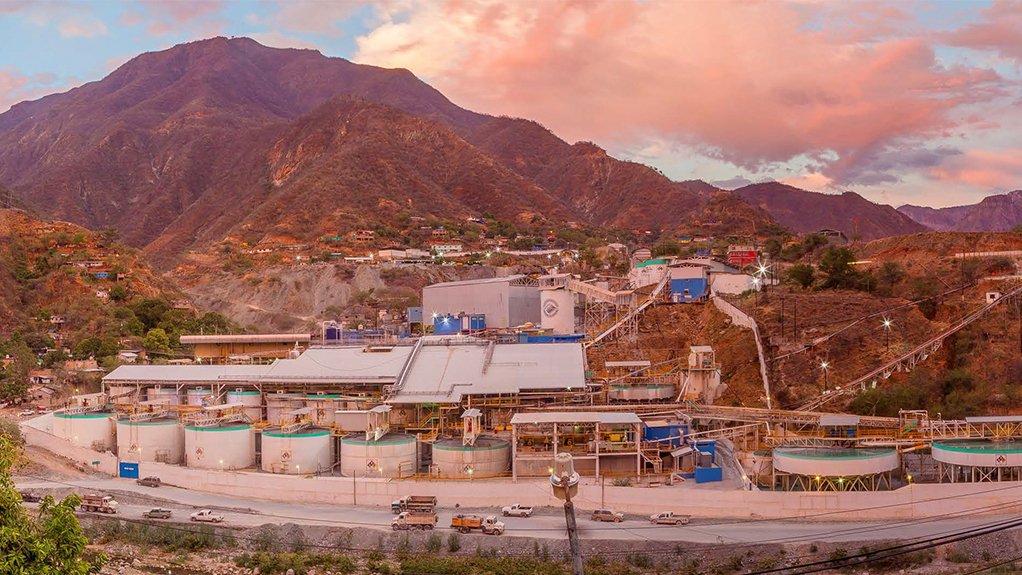

The deal will give First Majestic control of the San Dimas silver/gold miner, in Durango state, potentially adding between 4.5-million and 5-million ounces of silver and 60 000 oz to 70 000 oz of gold to First Majestic’s production profile and assisting the buyer to achieve its strategic goal of hitting more than 20-million ounces a year of silver output by 2020. For 2017, First Majestic has guided for total silver output of 10-million to 10.6-million ounces of silver, or 15.7-million to 16.6-million silver-equivalent ounces.

San Dimas is expected to have all-in sustaining costs of $1 050/oz to $1 150/oz of gold for 2017.

Critically, First Majestic has entered into agreements with Wheaton Precious Metals International, a subsidiary of Wheaton Precious Metals (WPN) to terminate the current silver streaming agreement after closing, following which First Majestic and WPM will enter a new stream arrangement based on 25% of the gold equivalent production at San Dimas, with ongoing payments of $600/oz of gold equivalent ounce delivered under the accord. As part of the transaction, WPM will receive 20.91-million common shares of First Majestic, valued at $151-million.

“The acquisition of Primero is a highly compelling transformative transaction that further enhances First Majestic's operating platform, adding a very high quality, long-lived asset in San Dimas, all in First Majestic's backyard in Durango, Mexico. Most importantly, the new stream and related amendments with WPM repositions the asset by maximising silver exposure for our shareholders, while significantly increasing the free cash flow from San Dimas,” First Majestic CEO Keith Neumeyer said.

The proposed repayment of the debentures, amounts outstanding under Primero's existing revolving credit facility and other costs related to the closing of the arrangement, totalling about $120-million, will be funded with a combination of First Majestic's current cash on hand of $118-million as of December 31; $150-million in new credit facilities committed by Scotiabank, which will replace First Majestic's existing credit facility; plus cash on hand at Primero.

Primero and First Majestic shareholders will vote on the proposed friendly merger at meetings to be held in March and closing is expected to occur before April.

Primero became distressed in 2017 following a prolonged strike at the San Dimas mine, and a subsequent unexpected slower phased ramp-up, which has forced it to pare back guidance and sell noncore assets in an attempt to prop up the balance sheet.

Edited by: Creamer Media Reporter

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here