JOHANNESBURG (miningweekly.com) – It is common knowledge that securing investment for exploration projects, particularly for junior operators, has been “extremely challenging”, owing to the current tepid global economic climate and low commodity prices, emerging gold miner Hummingbird business development head Robert Monro tells Mining Weekly.

“Despite these challenges, Hummingbird put together one of the largest fundraisers for a mining project in Africa over the past four years. This exceptional achievement is testament to the confidence the market has in our management team and project portfolio,” Monro enthuses.

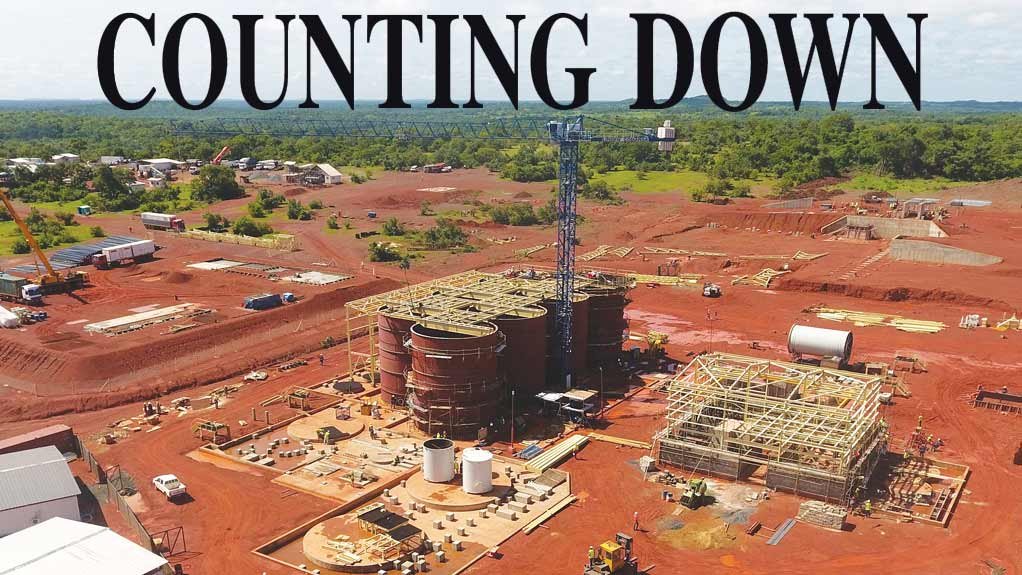

Hummingbird Resources has drawn down fully on its $60-million senior secured loan facility with financial institution Coris Bank International to fund the ongoing construction of its $88-million Yanfolila gold mine, in Mali, which is within budget and scheduled for first gold pour by December.

The latest draw-down of the $35-million balance from the debt facility, in July, followed the initial $25-million drawn in April. Monro states that, in 2016, the company also raised $75-million from its shareholders for its project development plans.

Johannesburg-based project management and engineering firm Senet is the primary contractor for the mine’s development, with Malian construction and engineering firm Imagri the primary subcontractor. The mine employs about 600 people, including contractors, and expects to grow its staff complement to about 900 employees once the mine is in production.

Monro notes that Yanfolila is targeting 132 000 oz of gold during its first full year of production, aiming to become a low-cost, high-grade openpit operation. The mine plan is to produce, on average, 107 000 oz/y from its two mining pits at an all-in sustaining cost of $700/oz over the life-of-mine. Ore will be processed in a carbon-in-leach gold recovery plant at an expected recovery rate of about 93%.

Hummingbird, however, aims to increase mine production to 150 000 oz/y by bringing a third pit into operation, which is located 5 km from its processing plant. This pit currently only has inferred resources and does not form part of the existing mine plan. “There is, nevertheless, a scoping study on the pit, which indicates that it has a higher-grade material of about 4.5 g/t of gold,” Monro points out.

The company has appointed Australian mining services company Ausdrill’s Africa subsidiary, African Mining Services (AMS), as the mining contractor for the project. AMS is on site and is scheduled to start preproduction mining by the end of this month.

Yanfolila has a total resource of about 2.2-million ounces of gold at 2.4 g/t, with reserves of about 700 000 oz of gold at 3.1 g/t. Based on current reserves, the mine has a life span of seven years. However, Monro notes that the mine has a large amount of resources within its permit areas that have not been drill-tested but could potentially add to the mine’s reserves.

“Once the mine is in production, we will continue exploration work on the project to expand its life span,” he states.

COMMUNITY BENEFITS

Moreover, Monro notes that the project has had tangible benefits for Mali. In addition to creating many new job opportunities directly through employment at the mine and indirectly through the provision of goods and services from local entities, the company has several corporate social responsibility initiatives in place.

These include paying the salaries of 20 teachers at nearby schools, providing financial support for local clinics and establishing market gardens, where villagers are trained to grow their own fruit and vegetables, some of which is bought by Hummingbird.

Monro points out that the company aims to ensure the creation of more jobs for Malians. Although the majority of the company’s workforce comprises locals, Hummingbird intends to boost this representation to 90% by offering skills training and education programmes at the mine and in the local communities as the project develops.

MINING IN MALI

Hummingbird bought Yanfolila from gold major Gold Fields for $20-million in 2014. The project had about $100-million in historical exploration spend on it and was fully permitted at the time of the transaction.

Monro tells Mining Weekly that, in the three years that the company has been operating in Mali, it has developed a good working relationship with local and national government officials.

According to a recent report by the Extractive Industries Transparency Initiative (EITI) – which promotes a global standard to ensure open and accountable management of natural resources – Mali has made meaningful progress in implementing the EITI standard.

The EITI’s board reached this decision following a validation process, which is the EITI’s independent quality-assurance mechanism and includes extensive consultations with stakeholders.

Mali has a long history of mining, with gold mining having been undertaken in the country since at least the fourth century, according to historians. However, the EITI notes that a military coup that toppled the democratically elected government in 2012 and multiple terrorist attacks in recent years have posed “significant threats” to economic activities.

The organisation highlights that mining activities are concentrated in the south and have remained mostly out of reach of the multiple armed groups that occupied the northern part of the country in the aftermath of the coup.

Mali remains Africa’s third-largest gold producer after South Africa and Ghana, with significant artisanal mining activities. The EITI notes that about 10% of the country’s gold output is produced by more than one-million artisanal miners. The rest of its production comes from seven mines using industrial methods.

Monro says that the country is an established mining hub, with a steady flow of new miners regularly entering the sector and a skilled workforce, which “definitely offers mining companies great all-round value”.

OTHER PROJECTS

Hummingbird’s other assets include the Dugbe gold project, in Liberia, about 60 km from the deep-water port of Greenville. The project comprises three prospecting sites – Dugbe F, Tuzon and Sackor – with a total defined resource of 4.2-million ounces of gold at 1.4 g/t across the deposits.

Dugbe is at early-stage development, Monro says, and, once Yanfolila has come on stream, greater emphasis will be placed on its development and more resources will be made available.

Hummingbird also holds a 5% interest in gold explorer Goldcrest’s Asheba prospect, in Ghana. The project has gold reserves of 175 000 oz at 1.8 g/t and is located 30 km from Gold Fields’ Tarkwa gold mine.

Additionally, Hummingbird entered into a memorandum of understanding in 2016 to combine certain of its noncore exploration permits in Mali with Africa-focused exploration company Kola Gold’s permits in Mali and Senegal. The parties established a new joint venture company, Cora Gold, in which Kola and Hummingbird each hold a 50% stake.

Cora has a portfolio of ten “highly prospective” gold exploration properties in two significant gold areas – the Kenieba Window, in Mali and Senegal, and the Yanfolila gold belt, in Mali, Monro points out. Cora has its own management and exploration team, led by senior exploration geologist Dr Jon Forster, who has a proven record of making discoveries and developing and operating mines across Africa.

Monro says that Cora plans to have an initial public offering “in the not too distant future” to assist in raising “very significant” additional working capital to start off an aggressive exploration campaign across the company’s assets. These campaigns will include drill programmes aimed at delineating maiden resources at the company’s licences.

“Cora will certainly act as an important vehicle for Hummingbird and Kola to unlock value at earlier-stage licences, which may otherwise have been neglected, as they would not have received the same priority within our respective asset portfolios,” Monro concludes.

Edited by: Creamer Media Reporter

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here