PERTH (miningweekly.com) – Western Australian gold miners have warned the state government that an increase in gold royalties would not only result in massive job losses across the state, but could also jeopardise the future of the sector as less money will be put towards exploration.

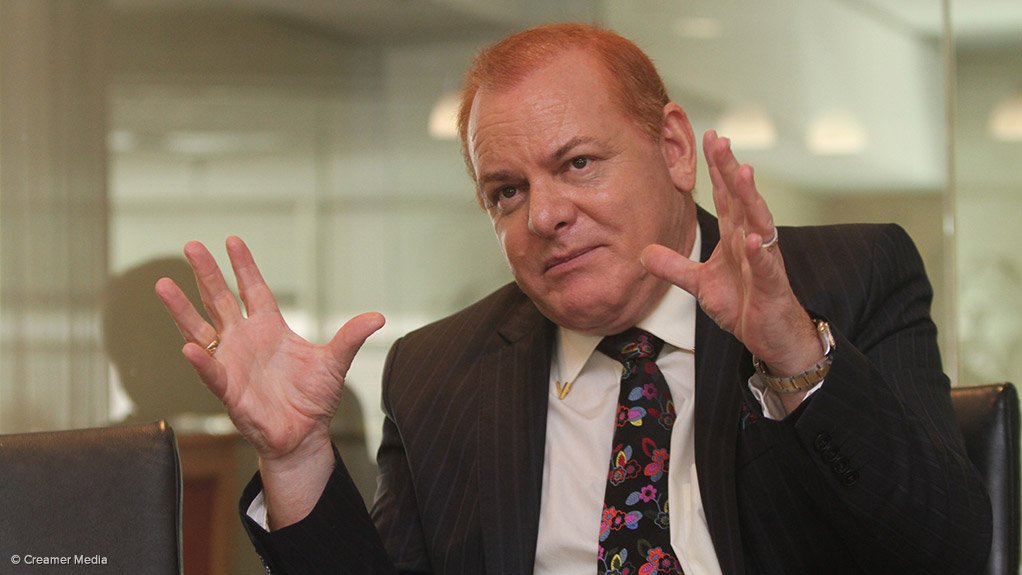

Speaking at a round-table in Perth on Wednesday, Gold Fields CEO Nick Holland said that exploration was a big item of expenditure for the company, which produces about 920 000 oz/y of gold from Western Australia alone.

Holland said that one of the first casualties of the proposed 50% increase in gold royalties would be exploration spend.

“If I look at the situation we have now, with this increase in royalty, in our business we have to find at least A$20-million a year that we have to take off our costs to neutralise the impact of this, and I’m afraid to say that one of the casualties will be exploration. We will have to trim our exploration budget, and I don’t know what the impact will be over the longer term.”

Holland also noted that royalty payments would also get factored into cutoff grade calculations, meaning that gold ore that was previously considered to be economical, would be sterilised.

AngloGold Ashanti senior VP Mike Erickson warned, too, that the rise in royalties would see the company cut exploration spend in Australia, particularly around the Sunrise Dam operation, where the miner was currently spending about A$60-million in upgrading the mine.

“To say that there will be no job losses [as a result of the royalty increase] is absurd,” Erickson said.

“I will have to look very hard at our exploration budget as well,” he added.

Northern Star executive chairperson Bill Beament pointed out that the proposed increase in gold royalties would result in a A$120-million-a-year hit to the industry’s bottom line, which equated to around 35% of gold exploration spent in the state over the last year.

“When you run a mining business, the only discretionary spend you have in your business is exploration, and this will bear the brunt of any tax increase,” Beament said.

“The only thing we can guarantee is that jobs will be lost. Western Australian gold companies have to survive in the global market, as we are a price taker. We compete with gold mines all over the world for capital, and we must be competitive to survive.

“If we fail to be cost competitive, which is already difficult given the relatively high prices we pay for labour, consumables and energy, we will not survive, and that will ultimately result in more job losses,” he added.

Gold miner Newcrest, meanwhile, warned that the future of its Telfer mine could hang in the balance, if the proposed royalty changes passed Parliament.

MD Sandeep Biswas said on Wednesday that the Telfer mine currently had the lowest profit margin of all Newcrest mines, and was considered not only one of the most remote mines in the world, but also one with the lowest grades.

“The bottom line is this: Telfer cannot sustainably absorb the royalty increase,” Biswas said, noting that the project was already faced with a number of challenges, including declining grades.

“A royalty increase puts our mine at Telfer at serious risk,” he said.

The Western Australian Chamber of Minerals and Energy earlier this week warned that some 3 000 jobs would be lost in the gold sector if the royalty rate is increased, with five operating mines with margins of less than 10% facing closure at current gold prices. If gold prices declined to A$1 400/oz, a further five operations could be faced with closure, with a further 2 000 jobs at risk.

Edited by: Mariaan Webb

Creamer Media Senior Deputy Editor Online

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here