JOHANNESBURG (miningweekly.com) – Deshnee Naidoo, who is leading the development of former Anglo American-owned zinc assets in South Africa’s Northern Cape, has just returned from a fruitful interface with the Tasmanian government, which has chosen to invest A$9.5-million in the proposed restart of the Mount Lyell copper mine, a Copper Mines of Tasmania (CMT) operation, which is part of the Vedanta group.

Involved is an operation that began in 1883 and which has been on care-and-maintenance for the last two and a half years.

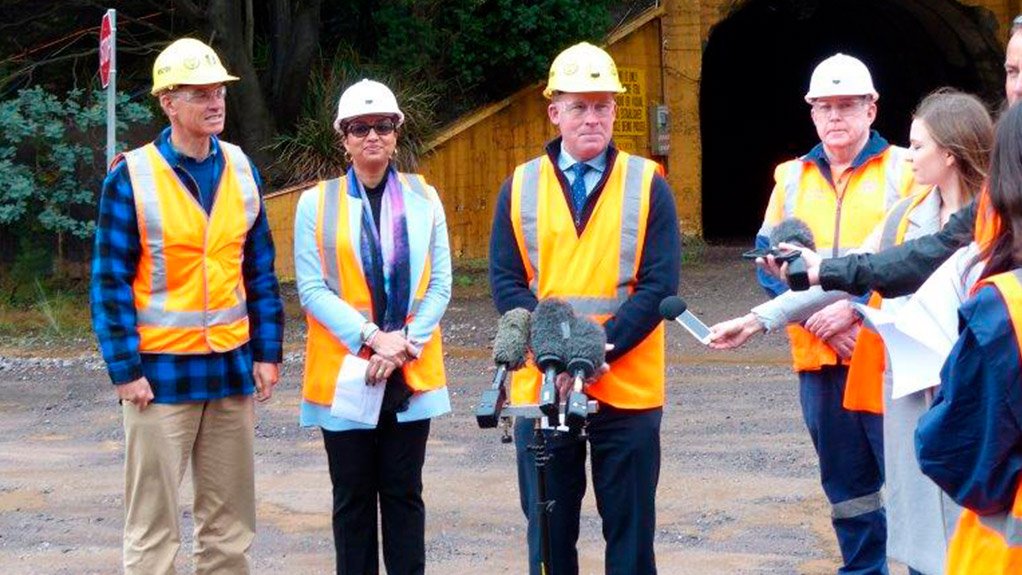

Naidoo, who is CEO of Vedanta Zinc International and CMT, was in Tasmania to meet Tasmanian Premier Will Hodgman and Tasmanian Resources Minister Guy Barnett to discuss the update on a CMT restart.

"This is an extreme display of the government’s commitment towards a restart. Although recognising that further study work needs to be completed before a firm restart decision is made, the government gave CMT A$9.5-million for activities to support an accelerated restart," Naidoo told Mining Weekly Online in an emailed response, in which she explained CMT's integral role on the West Coast of Tasmania and the firm government opinion that everything possible needs to be done to further support Vedanta, which has spent in more than $80-million in the past two and a half years of the operation being on care-and-maintenance.

Naidoo said that a restart decision would be taken by the end of the year, once the necessary study work was completed.

However, pre-start activities that the A$9.5-million supported would begin immediately and provide employment for 50 to 60 people.

She said the government of Tasmania encourages foreign investment, with CMT also being offered payroll tax and royalty relief for a period after restart.

The intention is to restart on operating parameters similar to those that pertained prior to care-and-maintenance, involving the production of 2.5-million tonnes of run-of-mine material a year.

In parallel, work would be done on de-bottlenecking options in hoisting and processing and on a targeted exploration plan.

Naidoo revealed that the team had also proposed a ‘green, reduced emissions’ restart by looking at using electric trucks.

The Premier told journalists that the investment would allow CMT to undertake a range of projects essential for the restart of operations and could potentially bring forward a restart by more than six months.

Reporting from Perth, Creamer Media Senior Deputy Editor Esmarie Swanepoel quoted the Premier as saying that the projects would begin almost immediately and create more than 50 to 60 new jobs at the mine in the construction phase.

“Importantly, this will move us closer to the restart of mining operations, which in the longer term will be expected to create up to 300 jobs,” Hodgman added.

The decision to restart operations at Mount Lyell could require a capital investment of between A$80-million and A$100-million, Naidoo revealed.

Since mining operations ceased in January 2014, CMT and Vedanta had invested around A$100-million in the project to develop new block cave mining methods, environmental projects, and on exploration and rehabilitation at the project area.

Barnett said that CMT’s recent announcement that it was reviewing restart plans on the back of improved copper prices meant that the present was the perfect time for the Tasmanian government to take decisive action to help bring about the restart.

The A$9.5-million government investment would support four key projects at the mine, including the A$4.5-million decline refurbishment, the A$1.5-million North Lyell tunnel rehabilitation, the A$2-million West Queen water supply pipeline replacement and the A$1.5-million associated infrastructure for the crushing mill upgrade.

Naidoo told journalists that the government’s investment would allow a restart decision much sooner, and would make it more likely, besides providing community and environmental benefits.

Barnett said CMT were investigating the redevelopment of the processing plant and ore handling circuit with the possibility of employing electrically powered trucks to bring ore to the surface.

“This is an innovative approach which would make the Mount Lyell mine the first fully electrified underground mining operation in Tasmania,” Barnett added.

Diversified mining company Vedanta, which is being associated with the acquisition of 11% of the equity of Anglo American by Volcan Investments because of the link both these entities have with Indian billionaire Anil Agarwal, has done well with the South African assets it acquired from Anglo seven years ago.

On the $1 338-million Vedanta paid for Anglo’s zinc assets in 2010, the London-listed, India-rooted company achieved full payback two years later through decisive underground and near-pit mining.

Naidoo has managed to shave close to $200-million off the project’s original capital estimate, taking it down to $400-million.

In a video interview with Mining Weekly Online last year, Naidoo again revealed Vedanta’s thrift culture in that the company is planning to use revenue generated during the Gamsberg project’s first phase to help fund its second phase, which will probably include a new 300 MW to 350 MW zinc refinery at a cost of nothing less than $500-million to $600-million.

A contract to establish and mine the Gamsberg opencast zinc operation has been awarded to Aveng Moolmans by Black Mountain Mining, a Vedanta Zinc International operation.

The contract award to Aveng Moolmans involves the setting up and commissioning of a concentrator plant and associated infrastructure for the opencast mine, which is located on one of the world’s largest undeveloped zinc deposits, 20 km east of the town of Aggeneys, in South Africa’s Northern Cape.

Engineering solutions provider ELB’s Engineering Services will oversee the construction of the process, power and water plants at the project.

Edited by: Creamer Media Reporter

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here