SANTIAGO - Chile's financial regulator said on Tuesday that a planned lithium joint venture between State-run Codelco and miner SQM does not need to face a vote by SQM shareholders as argued by China's Tianqi Lithium, which owns a fifth of SQM.

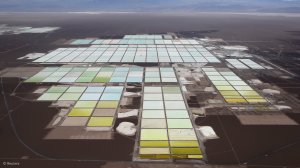

The deal would give the state a key role in producing lithium while letting SQM boost output of the battery metal. Chile is the world's second-largest producer of lithium.

Chile's financial regulator CMF determined that only approval by SQM's board was required and said arguments submitted by Tianqi did not have merit under Chile's financial regulations. "This Commission believes that it is not appropriate for an SQM Extraordinary Shareholders' Meeting to decide on the so-called Association Agreement, thus this transaction must be analyzed and resolved by SQM's Board of Directors," the commission said in a letter to Tianqi.

Tianqi, SQM's second-largest shareholder, did not immediately respond to a request for comment. The company can appeal the decision to the courts.

Codelco and SQM said last month they expected to resolve final conditions for the deal in the first half of 2025, but some analysts flagged the dispute with Tianqi as a risk. The tie-up will give Codelco a stake of 50% plus one share in the joint venture.

Tianqi has said it would consider legal actions to protect shareholder interests. The Chinese company complained the negotiations between SQM and Codelco lacked transparency and Tianqi got in a public spat with SQM.

Edited by: Reuters

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here