JOHANNESBURG (miningweekly.com) – Triple-listed Coal of Africa Limited (CoAL) and its subsidiary MbeuYashu have received a notice from diversified major Rio Tinto Minerals Development and Rio’s joint venture partner Kwezi Mining alleging that CoAL is in breach of a deferred consideration payable by MbeuYashu for a 2010 acquisition.

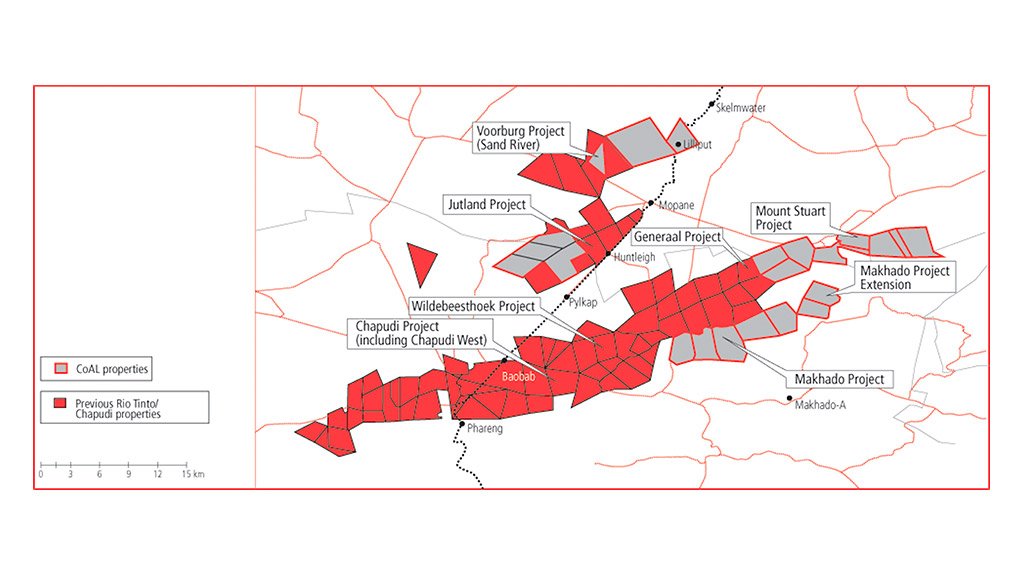

CoAL, in 2010, entered into a $75-million agreement to buy the Chapudi coal assets, adjacent to its Makhado project, in Limpopo, from Rio Tinto and Kwezi, with $45-million paid upfront in cash, and the balance of $30-million deferred until the sale had been completed in 2012.

By May 2015, CoAL had paid $8-million of the deferred amount. At that time, it also announced amendments to the initial agreement, which would see it settle the remaining $22-million by June 2017.

CoAL said on Tuesday that $56-million, which was 75% of the original acquisition price, had already been paid, with $19-million still outstanding.

“Payments to Rio Tinto and Kwezi are due finally by June 15, 2017. CoAL and MbeuYashu have met and will continue to meet all of our payment obligations to Rio Tinto and Kwezi,” the coal miner stated.

Rio Tinto and Kwezi were of the view that all amounts owed by CoAL and MbeuYashu were immediately due for payment.

However, CoAL said it would, based on legal advice, dispute the validity of the notice.

“If Rio Tinto and Kwezi pursue the matter, CoAL and MbeuYashu will defend it vigorously,” CoAL stated.

Edited by: Chanel de Bruyn

Creamer Media Senior Deputy Editor Online

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here