TORONTO (miningweekly.com) – The largest US iron-ore producer Cliffs Natural Resources rallied as much as 35% to $5.38 a share on the NYSE on Thursday, after swinging to a first-quarter profit amid sustained market improvement.

For the three months ended March 31, Cliffs recorded net income attributable to Cliffs' common shareholders of $108-million, or $0.62 a diluted share, compared with a net loss attributable to Cliffs' common shareholders of $773-million, or $4.26 a diluted share, recorded in the first quarter of 2015.

The latest period included a debt-restructuring and extinguishment gain of $179-million. Revenue dropped 32% to $305.5-million.

Analysts had expected a loss of $0.10 a share on revenue of $272-million.

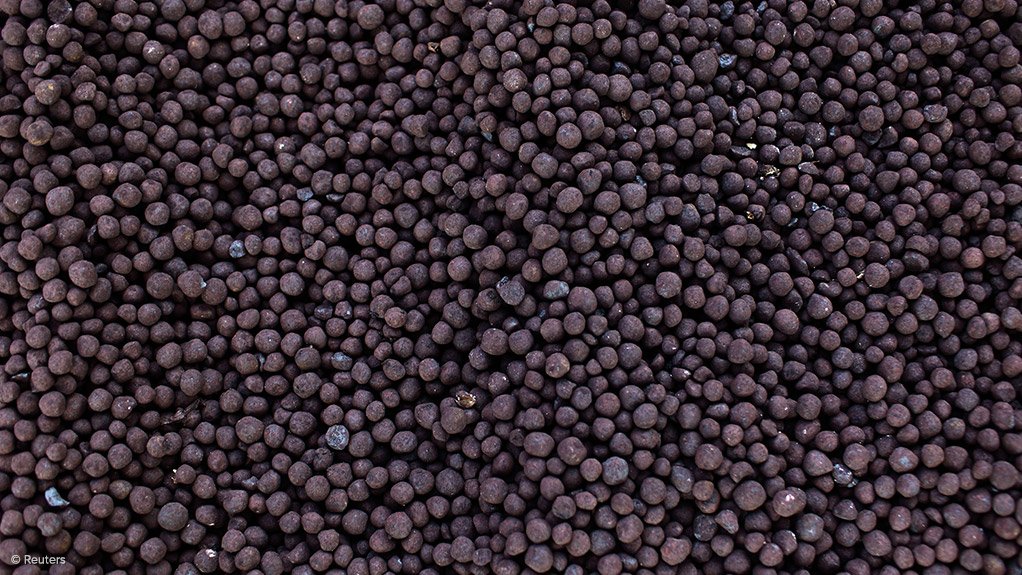

The company benefited from an iron-ore price that had improved by about 44% so far this year. "The steel market in the US has started to show consistent signs of a real recovery, with a direct positive impact on our steel clients' order books and, consequently, a totally expected improvement in our clients' appetite for the pellets we supply them,” stated Cliffs chairperson, president and CEO Lourenco Goncalves.

The company had raised its 2016 capital spending guidance to $75-million, an increase of $25-million, to produce a specialised super-flux pellet at United Taconite.

Goncalves noted that a newly adopted supply discipline going forward by the two Australian majors BHP Billiton and Rio Tinto, followed by a similar statement coming from their Brazilian peer Vale, had generated a more reasonable pricing environment for sinter feed fines in the international market for iron-ore, which continued to be short in lump ore and pellets.

Cliffs reduced its cost to produce iron-ore in the US by 26% to $48/t, the company said. Administrative costs were $28-million, down 3% from the first quarter last year.

Cliffs maintained its outlook to produce about 17.5-million tons of iron-ore in the US this year and 11.5-million tons in the Asia/Pacific region.

Edited by: Samantha Herbst

Creamer Media Deputy Editor

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here