JOHANNESBURG (miningweekly.com) – JSE-listed AngloGold Ashanti has disposed of its various South African gold and uranium mining assets in the Vaal river region to Harmony Gold Mining for $300-million.

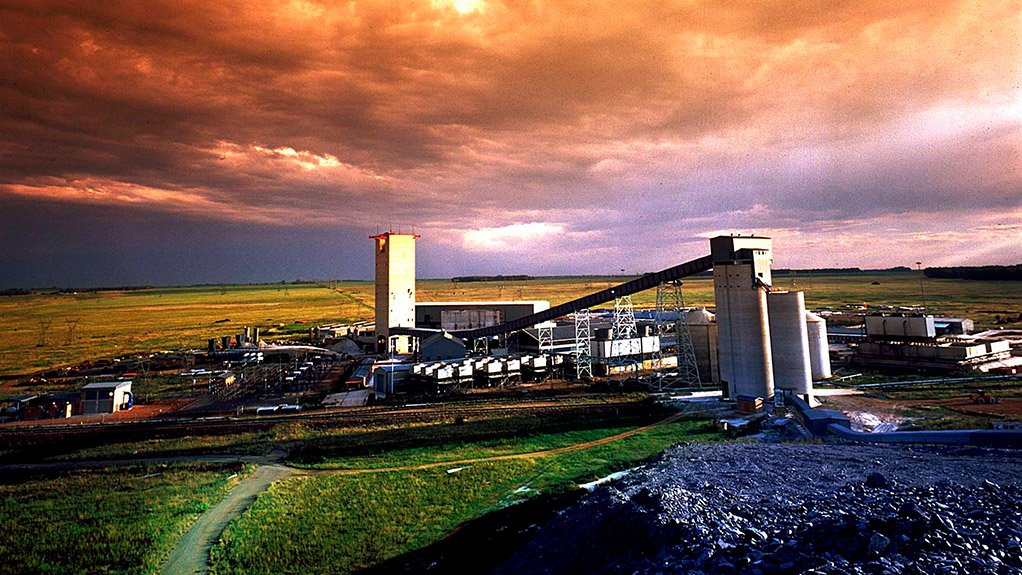

The transaction comprised the Moab Khotsong mine, the Great Noligwa mine and related infrastructure; AngloGold Ashanti’s entire interest in uranium calcining facility Nuclear Fuels Corporation of South Africa, or Nufcor; and AngloGold Ashanti’s entire interest in Margaret Water Company.

“This transaction is in line with our capital allocation strategy and our aim to effect the improvement of our global portfolio, through projects that extend mine lives, enhance margins and provide quicker cash returns on investment,” said AngloGold Ashanti CEO Srinivasan Venkatakrishnan on Thursday.

"Buying Moab Khotsong means we boost our cash flows by more than 60%, increase our average overall underground recovered grade by 12% and grow our South African underground resource base by 38%,” outlined Harmony CEO Peter Steenkamp, adding that the value-accretive acquisition was in line with Harmony’s strategy to grow, produce safe profitable ounces and increase margins.

The acquisition is expected to add more than 250 000 oz of gold at an all-in sustaining cost below Harmony's target of $950/oz and increase the group’s average recovered grade to 5.7 g/t.

The Moab Khotsong mine includes a brownfield mine-life extension option, Project Zaaiplaats, which is currently at prefeasibility stage, with indications of a potential extension of the life of operations by more than 15 years.

The deal remains subject to a number of conditions.

AngloGold Ashanti will use the proceeds to further reduce debt and strengthen the company’s balance sheet, which will afford it a greater strategic flexibility to fund its growth initiatives, including its development projects.

Meanwhile, AngloGold Ashanti has also sold the Kopanang mine, the West Gold Plant and related infrastructure to Hong Kong-headquartered Chinese capital management company Heaven-Sent SA Sunshine Investment Company (HSC) for R100-million in cash and the transfer of certain gold-bearing rock dumps from Village Main Reef to AngloGold Ashanti.

HSC currently holds a 74% interest in Village Main Reef, which operates the Tau Lekoa gold mine in the Vaal river region.

“Once ... [the] transaction closes, the Kopanang mine . . . will continue to operate under the ownership of HSC,” Venkatakrishnan commented.

The sale excludes the Kopanang gold plant and the Kopanang rock dump, which will be retained by AngloGold Ashanti.

The Kopanang disposal is still subject to a number of conditions, including securing the requisite regulatory approvals.

Following the sale of the Kopanang mine, production from AngloGold Ashanti’s remaining South African operations, comprising the long life Mponeng mine and the Mine Waste Solutions (MWS) surface operation, will make up less than 15% of the company’s estimated yearly production.

Further, AngloGold Ashanti will no longer have underground mining operations in the Vaal river region.

AngloGold Ashanti will retain the long-life MWS tailings retreatment operation, as well as the surface rock-dump reclamation operations in the Vaal river region, which will continue to be treated through the Kopanang gold plant, which will be retained by AngloGold Ashanti.

These two operations in the Vaal river region, together with the long-life Mponeng mine in the West Wits region, will form AngloGold Ashanti’s operating base in South Africa.

LABOUR UNION VIEW

Trade union Solidarity on Thursday said it supported both transactions, as it would save jobs that were previously at risk and ensure the sustainability of the mines.

The Moab Khotsong transaction impacts about 6 500 workers, with the possible opportunities to extend the life of the Zaaiplaats project by more than 15 years, depending on feasibility studies.

“We are calling on Harmony to maximise this value-add to its South African portfolio and to capitalise on the opportunities that are being created,” said Solidarity mining deputy general secretary Connie Prinsloo.

The eyes of the industry and that of all players, both national and international, will be fixed on Harmony and Heaven-Sent in the expectation that exponential growth and stability would be a breath of fresh air in the mining industry which comes at a time during which the industry is facing many challenges.

In addition, about 3 500 workers have been affected at Kopanang, which is currently undergoing a Section 189 restructuring programme.

“The sale of the Kopanang mine will prevent the mine from being placed in care and maintenance,” explained Prinsloo.

Solidarity believed the deals would contribute towards bringing stability to the mining sector.

Edited by: Creamer Media Reporter

EMAIL THIS ARTICLE SAVE THIS ARTICLE

ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here