LONDON – In 1917, Ernest Oppenheimer met with South African general and soon-to-be Prime Minister Jan Smuts to seek his blessing for a new mining company called Anglo American. Smuts wanted one assurance, the company was there for the long haul.

Anglo, along with its sister company De Beers, made Oppenheimer a billionaire and his descendants one of Africa’s richest families. The company became South Africa’s biggest, a conglomerate once spanning brewing, publishing and gold mining. Now a century later, Anglo is trying to cut many of the ties with the country where it all began.

While South African mines were cash cows for decades, Anglo now wants to sell them next year to cut debt accumulated during the commodity boom, when it spent $14-billion on Brazil’s Minas Rio. How to package the assets and which to include will be major choices for Anglo, and it faces opposition from a government pension fund that is also the biggest investor. With so much history and national identity wrapped up in the company, it will be a complicated divorce.

“South Africa’s economic development basically began with gold and diamonds, and Anglo was a major part of that,” said Dave Mohr, who helps oversee R110-billion as chief strategist at Cape Town-based Old Mutual Multi-Managers.

“Decisions were made to buy very expensive assets at the top of the commodities cycle. That’s their biggest problem and the main reason they’re now having to sell.”

UNWANTED MINES

Many of the South African operations weren’t profitable when metal prices were depressed, and allegations of widespread government corruption and uncertainty over mine regulation have long been a concern for investors.

The company will need to balance its goals of raising cash and paying down debt with the demands of the Public Investment Corporation (PIC), Anglo’s top shareholder and the state-owned manager of government pensions. Already, the PIC has repeatedly disagreed with plans to sell assets piecemeal.

Anglo operates 15 mines in South Africa alone, owns controlling stakes in Kumba Iron Ore and Anglo American Platinum and has other joint ventures.

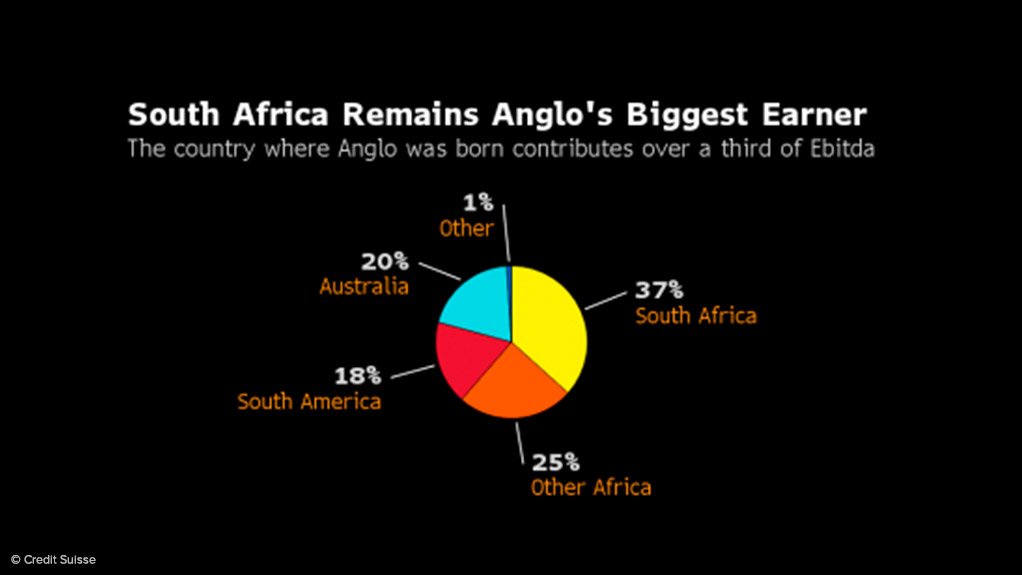

Anglo wants to sell its iron-ore, coal and manganese operations in South Africa, and retain the Venetia diamond mine and some platinum mines including Mogalakwena, the world’s biggest openpit platinum mine. That would reduce the country’s Ebitda contribution to 15% from 37%, according to Credit Suisse Group AG.

SHAREHOLDER PRESSURE

Platinum may be a sticking point. The PIC is pressuring Anglo to include the prized platinum assets in the divestment, according to people familiar with the matter. That sets up a conflict for Anglo’s CEO Mark Cutifani, who considers platinum a core commodity, along with copper and diamonds.

Anglo is leaning toward bundling the South African assets into one listed entity, instead of selling them off piecemeal, according to people familiar with the matter. The miner wants cash from any divestment to pay down debt, said the people, who asked not to be identified because the talks are private.

One option being considering is to combine Kumba, which owns Africa’s largest iron ore mine, with Anglo’s coal and manganese operations, according to the people. Any bundling with Kumba is likely to require wide investor backing, one person said. Anglo shares have quadrupled this year, making a spin off more palatable to investors.

But there are other alternatives. The company could decide to sell the assets separately, a plan that Anglo originally favored.

“We continue to work through all the various options for divesting the thermal coal and Kumba iron ore assets in South Africa, which may include packaging them for sale to create a new South African mining company,” Anglo said in an e-mailed statement.

In Anglo’s favour, as metals prices rebound, there’s less pressure on the company to quickly raise cash, giving it time to find the best solution, said Paul Gait, an analyst at Sanford C. Bernstein in London. He estimates the plan can be found in the next 12 months, even if the eventual retreat takes two to three years.

“All options are on the table for Anglo,” Gait said. “What’s critical is that they don’t remove any options too soon.”

Edited by: Bloomberg

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here