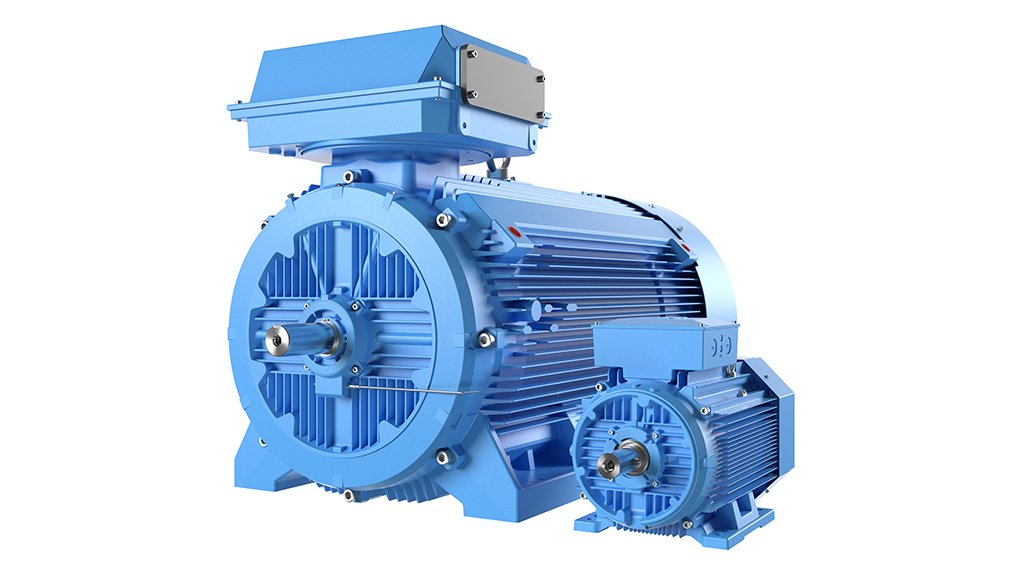

Bearings and power transmission supplier Bearings International (BI) is aiming to provide a comprehensive support service for engineering company ABB Africa’s motors this year, which the company now distributes in Southern Africa, says BI business unit leader Stephen Bekker.

“We aim to provide comprehensive support for low-voltage ABB motors. This would include covering sales, stock, technical support, application support and spares.”

In November last year, it was revealed that low-voltage IE3 motors from ABB Africa would be distributed in Southern Africa by BI. This was an extension of the pre-existing partnership between the two companies, with BI being a mechanical power transmission (MPT) partner of ABB since 2011.

Under the MPT partnership arrangement, BI distributed the Dodge brand of gearboxes – a brand that belonged to ABB at the time but has since been divested to drive chain solutions company RBC Bearings in July last year for $2.9-billion. The MPT partnership has evolved to encompass high-efficiency motors from ABB, with the potential for supplementary products in future.

Despite the divestment, BI remains a channel partner under the ABB Value Provider Programme for distributors. The comprehensive programme includes marketing support and training. BI also continues to supply and support Dodge gearboxes.

As a distributor of globally recognised brands, BI has been a long-time supplier of what was previously known as Bauer electric motors – now rebranded as Alpha electric motors – for the past 15 years.

However, Bekker tells Engineering News the company identified a need for high-efficiency IE3 electric motors as well, which are often specified by the mining industry. ABB was a natural fit to provide these motors, considering its close working relationship with BI.

“We’ve found that ABB motors are installed in many countries across Africa, so we aim to make ABB low-voltage motors more accessible for end-user sales. We are also seeing greater demand in South Africa from an original equipment manufacturer and project sales perspective,” he explains.

The advantages of the partnership with ABB include dealing with a local supplier, compared with the delays often associated with direct imports and the unavailability of quick technical backup support. Under the distributor agreement, BI has extended its motor range in size, with a 400 V and 525 V offering, allowing it to supply projects in the mining industry.

ABB, in turn, can leverage from BI’s extensive 47-branch network across South Africa, covering all the major mining and industrial areas where BI has a major footprint.

Bekker says the availability of IE3 high-efficiency motors from ABB has been welcomed by these sectors, where cost-effectiveness and total cost of ownership are key in an increasingly difficult trading environment.

Ramping Up

BI is recruiting and training several electric motor experts to cover each of the main mining and industrial areas where the company has a presence, to reassure customers that any technical support is readily available, in addition to backup advice or expertise.

Bekker says the bulk of last year was spent getting stock orders in after doing thorough market analyses to understand target customers and industries and determining the correct pricing models.

However, global manufacturing and shipping delays because of Covid-19 slowed down the process.

The IE1 stock arrived in South Africa in September, with the IE3 stock arriving only last month.

Further, most low-voltage motor purchases in South Africa are driven primarily by price, Bekker says.

“On average, the capital outlay accounts for less than 5% of the cost of a motor over its life span. A small percentage is maintenance, but the majority is electricity consumption costs. The average payback on the additional capital cost can be achieved in less than a year in most cases,” he notes.

A motor’s life span should be about 10 to 15 years, or even longer, which would provide the customer with more than eight times the savings of the additional capital outlay.

“With electricity costs getting higher, the reasons for using more efficient motors are more justified,” Bekker comments.

By design, to achieve higher efficiency, electric motors run cooler, which prolongs the insulation life span, therefore increasing the reliability of the motor.

Bekker says the complete offering of ABB motors will range from 0.55 kW to 355 kW, and higher kilowatt motors can be supplied on request.

“However, we are concentrating on the 15 kW to 250 kW four-pole motor range, which we believe makes up to 70% of IE3 motor sales in our target market.”

A large portion of the ABB IE3 motors is aimed at the South African mining industry.

“In South Africa, mining has always been a successful sector, and with high commodity prices and projects coming back online after Covid-19 delays, this will be a key focus for us,” Bekker says.

However, he notes that the mining sector is not the only sector with growing demand – the sugar, pulp and paper, and the water industries are also on BI’s radar.

“With ABB’s extensive range, we can offer quality solutions to all industries. For example, ABB has a successful motor range specifically aimed at the food and beverage industry,” Bekker concludes.