The decrease in size and scope of mining investment events, such as Australia’s annual Africa Down Under, is a reflection of the state of the global mining economy and the lack of funding available for the development of projects, South African State-owned minerals processing and metallurgical engineering products provider Mintek GM Alan McKenzie tells Mining Weekly.

The 2012 Africa Down Under conference attracted 2 450 delegates, but last year the three-day conference in Perth, Australia, lured just over 1 000 delegates, according to the event’s website.

Having attended the event over the past five years, McKenzie has seen the number of projects, exhibitors and attendees at the event decrease substantially, and he expects the trend to continue in 2016. The event is taking place from September 7 to 9 and aims to bring key members of the African and Australian mining sector together in efforts to spur Australian investment in African mining projects. Australian resource sector news media organisation Paydirt has organised the event for the past 14 years.

McKenzie states that looking back eight years to a time before the global economic crisis, hundreds if not thousands of projects were being considered across Africa. While very few of these projects have been completely terminated, he reports, most of them are in “a state of limbo”, owing to the lack of available funding that most will never secure.

McKenzie explains that the majority of these projects were started by junior mining firms that sought funding from Toronto markets, with Australia also having played a key role in investment into the junior mining sector. Many companies have listed on the TSX in an attempt to obtain funds; however, this capital raising route has largely dried up, he laments.

McKenzie reports that, in recent times, Chinese investment has been one of the few strong sources of funding for junior mining projects, with 80% of the African projects that Mintek is involved in having benefited from at least some form of Chinese investment. He states that, although China is leading this trend, Japan and Korea are not far behind. This, McKenzie says, is because these countries have made it a priority to secure resources for the future.

The theme of the Reserve Bank of Australia’s conference held in March was ‘Structural Change in China: Implications for Australia and the World’.

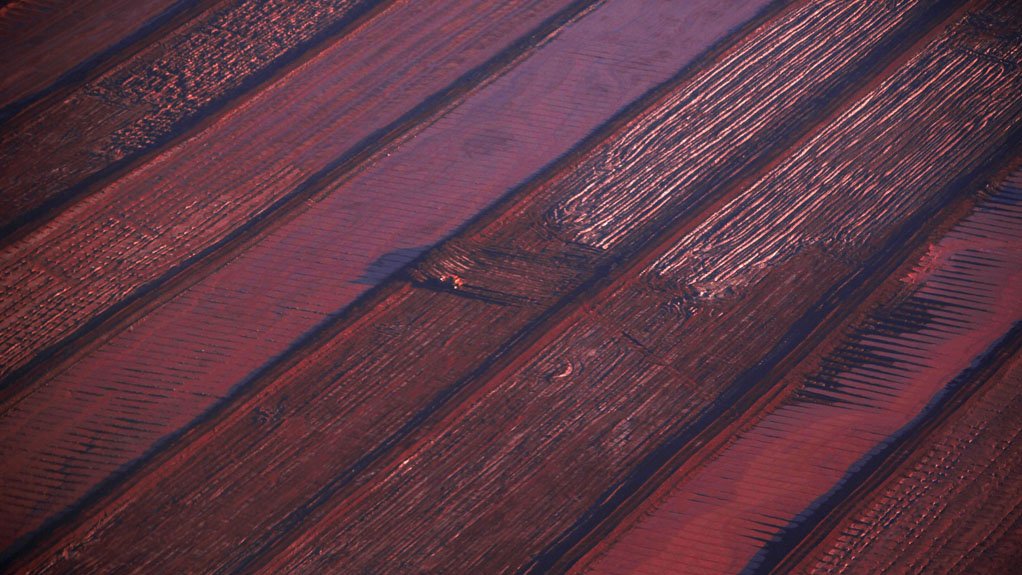

According to a draft paper presented at the event – ‘China’s evolving demand for commodities’ – written by Ivan Roberts, Trent Saunders, Gareth Spence and Natasha Cassidy, while Chinese growth is continuing at a slightly reduced rate of 6% to 7% a year as opposed to double-digit growth a few years ago, it is reliant on imports. An example of this is the recent increase of iron-ore shipments (including from Australia) as plants increase stock inventories. These are short-term fluctuations within a longer-term trend of continued growth.

McKenzie explains that the report documents the widespread perception that economic growth will continue to ease off in China, which has raised doubts about the future growth of Chinese steel and iron-ore demand. A view is emerging among analysts, the report states, that steel demand in the country is close to peaking, or may have already done so. Analysts speculate that the country’s steel demand is destined to start to fall within the next decade. China’s transition to a more consumption- and services-driven economy implies a levelling off in its steel intensity growth, says McKenzie.

China, Japan and Korea are large manufacturing nations, he notes, but with limited resource bases. In an effort to protect their future income generation, these countries are trying to invest in mining projects in Africa to secure the raw materials needed to maintain the production of their industry going forward; a trend, McKenzie says, has been growing.

Copper and base metals operations on the continent are receiving the majority of Chinese investment. However, phosphates and fertiliser minerals operations, predominantly located in the coastal regions of Egypt and Eritrea and the west coast of Africa, are experiencing a boost in investment as the market for these commodities has grown over the last few years in response to the increase in demand for fertilisers to ensure global food security.

Australia also exports vast supplies of commodities, including iron-ore, gold, liquid petroleum gas and crude petroleum, to China, Japan and South Korea, which are also some of its biggest export destinations.

Royalties Demanded

McKenzie explains that many African countries, such as Ghana, Zambia, Zimbabwe and Sudan, are emphasising mining activities as part of their efforts to increase employment levels and solve economic challenges. Mining is seen as something of a “silver bullet” in this regard, he explains, adding that there is much talk about the expansion of the mining sector in Africa.

As with many other countries across the world, governments are expecting high royalties and returns for allowing mining companies to operate within its borders, regardless of falling commodities prices. He states, however, that looking to fund economic development through mining is problematic (including in South Africa).

In many cases, this taxation has reached an “extreme level owing to the harsh economic climate”, as many of these projects and mining operations are simply not financially viable under the circumstances. The recent upheavals in the Zambian base metals sector are a case in point.

Governments of developing nations must be careful not to expect “too big a slice of the cake”, stresses McKenzie, noting that royalty payments can be an impediment to the development of the industry. These countries have every right to a fair return; however, “the last time you should be squeezing someone is when they are on their knees”, he warns.

Encouragingly, Ghana signed an agreement with gold producer Gold Fields this year that includes a reduction in the corporate tax rate from 35% to 32.5%, effective since March, and a change in the royalty rate from a flat 5% of revenue to a sliding-scale royalty based on the gold price, which becomes effective in January 2017.

Beneficiation Battle

The process of beneficiation is also top of the agenda among Africa’s commodity-rich countries, which McKenzie states is not so in Australia. He explains that Australia is a particularly large country with more mineral resources and a lower population level, compared with countries like South Africa, therefore, it is capable of relying on mineral ore sales for much longer.

McKenzie states that often the most profitable part of the mining chain is selling the ore. This means that, for the most part, particularly among junior mining companies, there is a disincentive to beneficiate and it does not normally form part of companies’ core business, as it tends to add a level of complexity to operations that is unwanted by management, as well as lowers financial return.

He states that finding a suitable balance in which all parties are happy with their received return is a major challenge in the industry. Owing to this, McKenzie concludes that the Australian mining industry may have an upper hand on competitors around the globe as it is not as insistent on beneficiation as many other countries and, thus, is perhaps more attractive to many investors. This, however, does not apply to Australian companies operating in Africa where there may be a strong push for additional beneficiation.

Edited by: Tracy Hancock

Creamer Media Contributing Editor

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here