In a drive to increase sales into Africa across all of its companies, the Hudaco Group has structured its exports division into smaller clusters, each with a specific product focus. Here Bearings International (BI) falls into the materials-handling cluster comprising of five companies, namely BI itself, Astore Keymak, Belting Supply Services, Bosworth and Brewtech, which are all engaged in a combined effort to grow their footprint across the continent.

GM Christian Chipamaunga heads up the Exports Division at BI, with Fred Aslett as Business Development Leader of the Materials-Handling Cluster itself and Attie Tiley as Business Development Leader for Exports.

The key countries for the year are Ghana, Tanzania, Zimbabwe, Botswana, Namibia and Mozambique, with the cluster focusing on mining, agriculture, manufacturing, FMCG and the food and beverage sector. “These listed countries are focus points. However, we are aware of ongoing projects in other African countries,” says Aslett. “We assist anywhere in Africa should there be an interest,” adds Tiley.

The product focus itself is largely driven by customer demand and varies month to month. However, there are specific seasonal products across the cluster that receive special attention in terms of stock costing and availability in order to be able to meet customer needs. The materials-handling cluster itself holds certain key contracts in various sectors and countries.

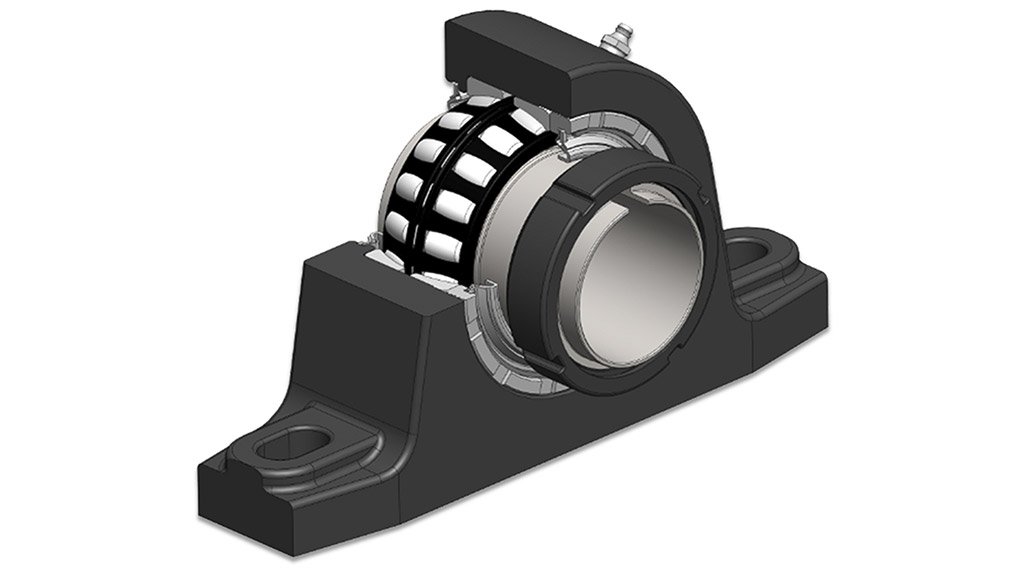

“There are opportunities across all industries for all the companies in the cluster to supply into Africa,” says Tiley. Mining and cement, for example, are industries that have a critical spares list of parts essential to production. Examples include crusher or SAG mill bearings, which require a plant shutdown in order to be replaced, which means it is imperative to minimise any downtime and impact on production.

“Having an export division is key to growth and untapped markets in Africa. We understand the African market and can meet our customers’ needs on a supply and service level. An export division is more than just selling cross-border; it is more about understanding different cultures and the way that African markets engage in business. Thereafter, selling products becomes second nature. We are also continuously visiting our customers across our African footprint in order to build trustworthy business relationships,” says Aslett.

“Some local customers have African operations, which can assist greatly in getting the correct product to them on time. Where there are countries that struggle to obtain certain products, BI is able to offer these at a highly competitive price so as to extend the range available in-country and reduce logistics costs,” says Tiley.

In terms of challenges, Aslett points to ever-increasing transport costs and the importance of short lead times. Container and shipping costs have surged, while the Covid-19 pandemic has necessitated a staggered supply chain approach due to travel restrictions and certain borders being closed. “Covid-19 and the restrictions it has placed on travel alone has certainly added a new dynamic to planning country visits.” However, BI has been able to leverage its vast product range and extensive branch network to ensure that customers are able to obtain all of their engineering supplies from a single source, which further reduces transport costs into Africa.

Despite such constraints, exports remain an area likely to expand rather than contract in the near future. “We are currently growing our Mozambican footprint by signing up key distribution partners to stock our products, as they can move around in-country far more effectively and continuously. We are following a similar approach in Namibia, where we have also identified service opportunities for the materials-handling cluster,” reveals Aslett.

“There are many opportunities we can take advantage of, especially as there are still countries struggling to get quality products at fair prices. Although suppliers are trying to get into African markets from around the world, we have a distinct advantage as we are in Africa and have the necessary products and services that these markets require. When the Covid-19 restrictions start to ease up, or we learn to work within these restrictions, we should start to see business expanding,” says Tiley.

Aslett concludes: “Africa remains a challenging but exciting environment for growth. If you can meet the needs of potential customers on the continent, the opportunities are endless.” Tiley concurs, stating that the mining industry remains buoyant in Africa. “Where there are mining projects, there will always be a need for infrastructure, agriculture and food-processing,” he highlights.